Private equity (PE) activity in the digital health sector has not fulfilled expectations, given the significant growth of PE investment in the broader healthcare industry. This trend prompts an exploration into the reasons behind this lag and when an increase in investment activity may be anticipated.

Private Equity in Healthcare: A Rising Trend

Over the past decade, PE investment in the healthcare industry has seen substantial growth, with a deal volume nearing $29 billion in North America alone. This surge of PE investment in healthcare companies has drawn governmental attention, leading to antitrust scrutiny. The Office of Inspector General for the United States Department of Health and Human Services (HHS-OIG) has raised concerns about the impact of ownership incentives on the quality and efficiency of healthcare delivery. Despite the heightened political and regulatory interest, the number of qui tam False Claims Act (FCA) cases targeting PE investors remains relatively small. Therefore, investors are advised to take precautionary measures such as conducting pre-acquisition diligence, aligning incentive structures, investing in a robust culture of compliance and considering the role of PE-owners in active management to mitigate future risk.

Private Equity and Medical Practices: A Declining Interest?

Contrary to the general trend, PE transactions with medical practices experienced a sharp decline last year. The goal in these transactions is to restore the income reduction by increased reimbursement, improved operations, or ancillary income. However, it has become more challenging to achieve these objectives as margins tighten and debt increases. Some medical practices have encountered difficulties due to high debt loads. Additionally, the Federal Trade Commission (FTC) has tried to curb practice consolidations, and studies suggest that private equity investment may lead to price inflation.

Cautionary Tales of Private Equity in Healthcare

Steward Health Care’s financial decline serves as a warning to health systems considering private equity investment. PE investors typically aim to cut costs and sell organizations, potentially leaving providers and communities to address any subsequent fallout. Concerns about private equity ownership of hospitals have reached Congress, and studies have revealed an increase in hospital-acquired infections and pressure ulcers at private equity-owned facilities. Given these issues, PE investors are now showing a preference for specialty care and outpatient care. However, some private equity-backed healthcare providers have faced bankruptcy and service cutbacks.

The Future of Private Equity in Digital Health

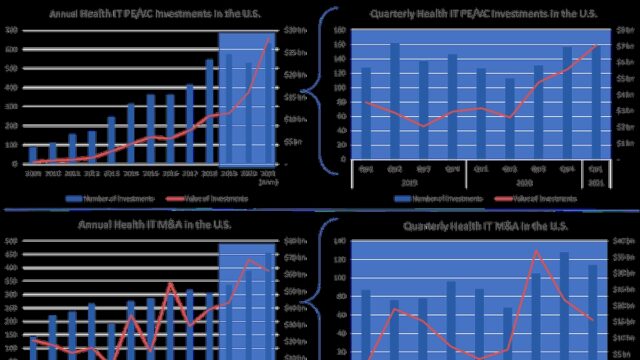

The Health IT Market Review highlights the influence of regulatory and economic forces, such as the HITECH Act and the Affordable Care Act, on the health IT landscape. The COVID-19 pandemic has further impacted digital health investment, leading to a resurgence of health IT M&A activity. Despite the existing valuation gap, recent transactions suggest that investors see opportunities at these valuations. Therefore, while the current private equity activity in digital health may be lower than expected, there are positive signals indicating a potential increase in the future.