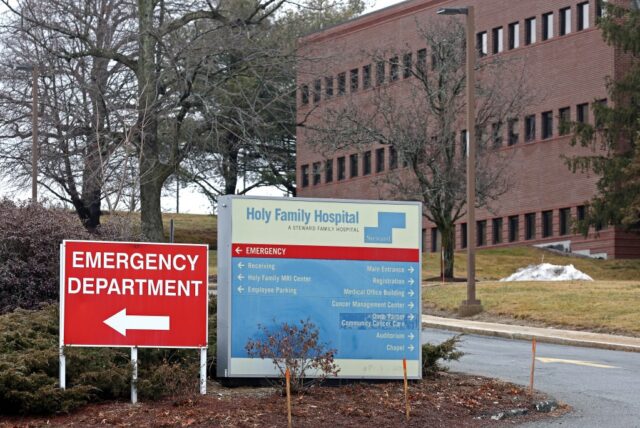

Steward Health Care is reportedly trying to sell a number of its Massachusetts hospitals, including Holy Family Hospital in Methuen. (Staff Photo By Stuart Cahill/Boston Herald)

Rep. Lori Trahan brought the Steward Health Care System crisis before a Congressional committee Wednesday, calling for more transparency into the “disastrous” role of private equity in the financial instability threatening hospitals in Massachusetts.

“Families who receive care at Holy Family Hospital and Nashoba Valley Medical Center – both owned by Steward – were recently notified that their care is now in jeopardy because of the corporation’s gross financial negligence that’s seeing the company try to shutter 4 of the 9 hospitals they own in Massachusetts,” Trahan said during a House Energy and Commerce Committee’s Health Subcommittee.

The comments follow revelations earlier this month that the Dallas-based system, the largest private for-profit health care network in the country, reportedly owes $50 million in unpaid rent and is subject to over a dozen lawsuits since 2022 alleging unpaid invoices.

The network owns nine hospitals in the Commonwealth and has been reportedly seeking to sell four, including Nashoba Valley in Ayer, St. Elizabeth’s Medical Center in Brighton, Holy Family in Haverhill and Methuen, and Norwood Hospital.

Steward announced it would shutter New England Sinai Hospital in Stoughton in December after losing $22 million. The hospital is set to close in April, and the Department of Public Health scheduled a public meeting in-person Wednesday at 6 p.m.

During the Congressional committee hearing, Trahan called out the health system’s lack of clarity around these financial shortcomings.

“For their reasoning, Steward executives have pointed to, you guessed it, low Medicaid reimbursement rate as the cause of their financial distress,” Trahan said. “But earlier this month, it was revealed that the company has missed rent payments to an ‘outside landlord’ that actually owns the property and buildings their facilities operate in.”

During the hearing Families USA Senior Director of Health Policy Sophia Tripoli offered testimony, arguing greater transparency and scrutiny of health care systems’ private equity is a “critical first step.” Insight into mergers and acquisitions, she said, can help empower state and federal regulators and avoiding situations like Steward ongoing financial instability.

Governor Maura Healey has stated in the last week the state is taking steps to maintain the “stability” of the system and mitigate the situation for the local communities.

A spokesperson for the Executive Office of Health and Human Services gave no more details on the state’s plan to address the situation but maintaining safe and high-quality health care and supporting the workforce is a “top priority” of the administration.

“When healthcare facilities or services close, we are always concerned about any potential disruption to patients, healthcare workers, families, and communities,” the EOHHS spokesperson said. “DPH will continue to closely monitor and work with Steward to protect patients, preserve jobs, and maintain quality.”

The state Legislature will also hear testimony on a bill filed by Rep. Natalie Higgins which would block hospitals from closing for three years if the state deems them “necessary for preserving access and health status in the hospital’s service area.”