In recent years, a significant trend has emerged in the healthcare industry – the increasing involvement of private equity firms in acquiring medical practices and hospitals. According to studies, the number of acquisitions made by private equity firms increased from 75 deals in 2012 to a staggering 484 deals in 2021. Not only is this trend reshaping the healthcare sector, but it is also raising concerns about its potential impact on patient care and safety.

The Goal of Private Equity Investments in Healthcare

Private equity firms are primarily motivated by the goal of maximizing returns on their investments. They acquire medical practices, streamline their operations to make them profitable within 5-7 years, and then sell them off for a profit. These firms provide capital support to smaller practices, enabling them to scale their operations and improve their negotiating power with insurers.

However, the drive for profitability often leads to cost-cutting measures, including staff reductions, which can adversely impact the patient experience and quality of care. As highlighted by a colleague’s experience who sold his cardiology practice to a private equity firm, the process can result in increased costs and reduced access to care, posing potential threats to patient safety.

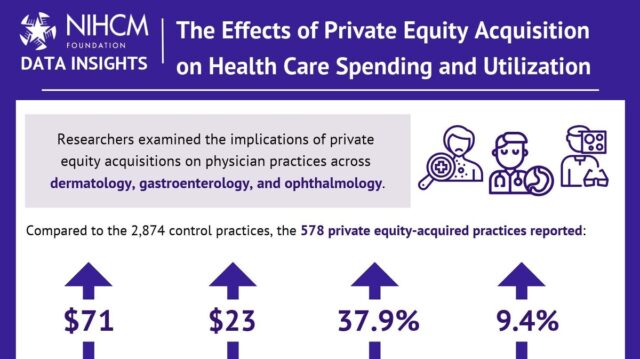

The Impact of Private Equity Acquisitions on Healthcare

The estimated annual acquisition values of health care-related private equity deals have surged from $41.5 billion in 2010 to $119.9 billion in 2019. This growing involvement of private equity firms in the healthcare sector has several implications. For one, it can lead to reduced staffing levels as these firms seek to reduce operating costs. This can, in turn, compromise patient safety and care quality.

Additionally, the focus on profitability may result in the misallocation of societal resources. Instead of investing in measures that genuinely improve patient outcomes, resources might be diverted towards strategies that simply enhance the bottom line of these firms.

Addressing the Concerns

The increasing trend of private equity acquisitions in the healthcare sector underscores the need for robust enforcement of antitrust rules and greater oversight of these acquisitions. Furthermore, real action on patient safety is required to ensure that the quality of care is not compromised in the pursuit of profitability.

Physicians considering selling their practices to private equity firms are advised to seek legal counsel. This can help ensure they get the best deal while maintaining clinical control over their practices. It is also crucial for physicians to consider the potential impacts on patient care and safety before making the decision to sell.

In conclusion, while the involvement of private equity firms in the healthcare sector can provide financial support to smaller practices, it also raises concerns about patient care and safety. As such, it is crucial for policymakers, healthcare providers, and stakeholders to carefully consider these implications and take appropriate measures to ensure patient care remains the primary focus in the sector.