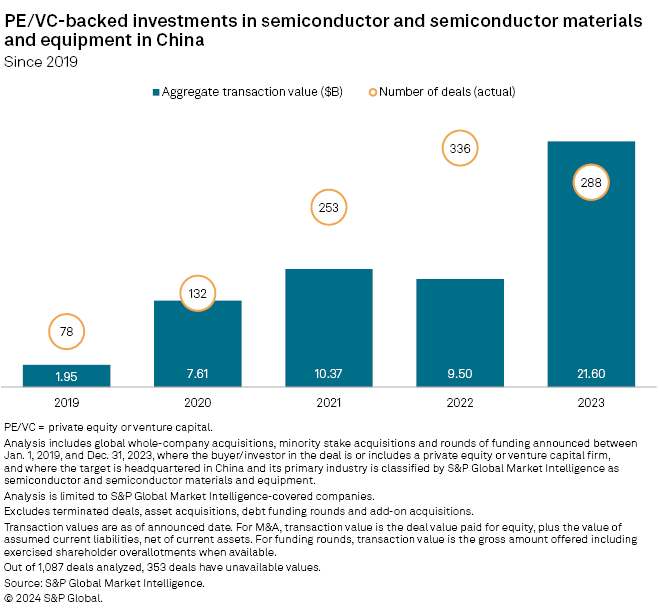

Private equity deal value in mainland China’s semiconductor industry surged 127.4%, driven by domestic private equity firms, according to S&P Global Market Intelligence data.

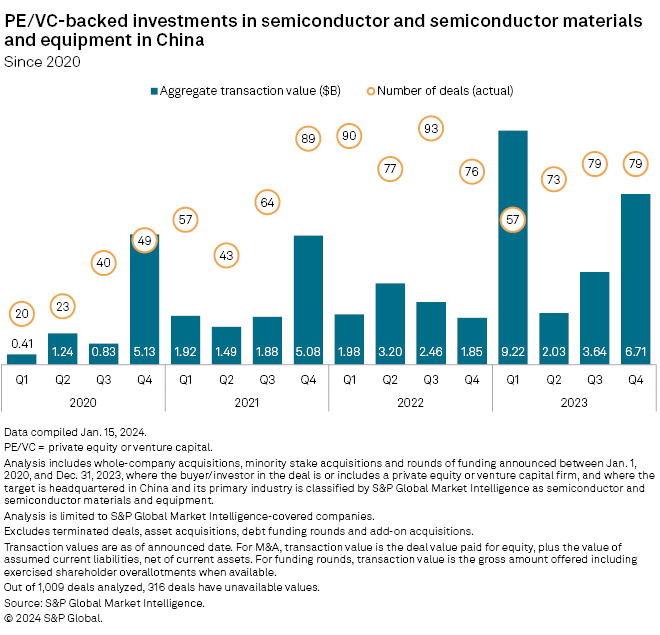

The aggregate transaction value in the sector to Dec. 31, 2023, was $21.60 billion across 288 deals, compared to $9.50 billion across 336 deals in 2022.

In the fourth quarter of 2023, private equity-backed investments, including whole company and minority stake acquisitions and funding rounds, totaled $6.71 billion, up from $1.85 billion recorded in the year-ago period.

The number of announced deals increased to 79 from the 76 recorded in the fourth quarter of 2022.

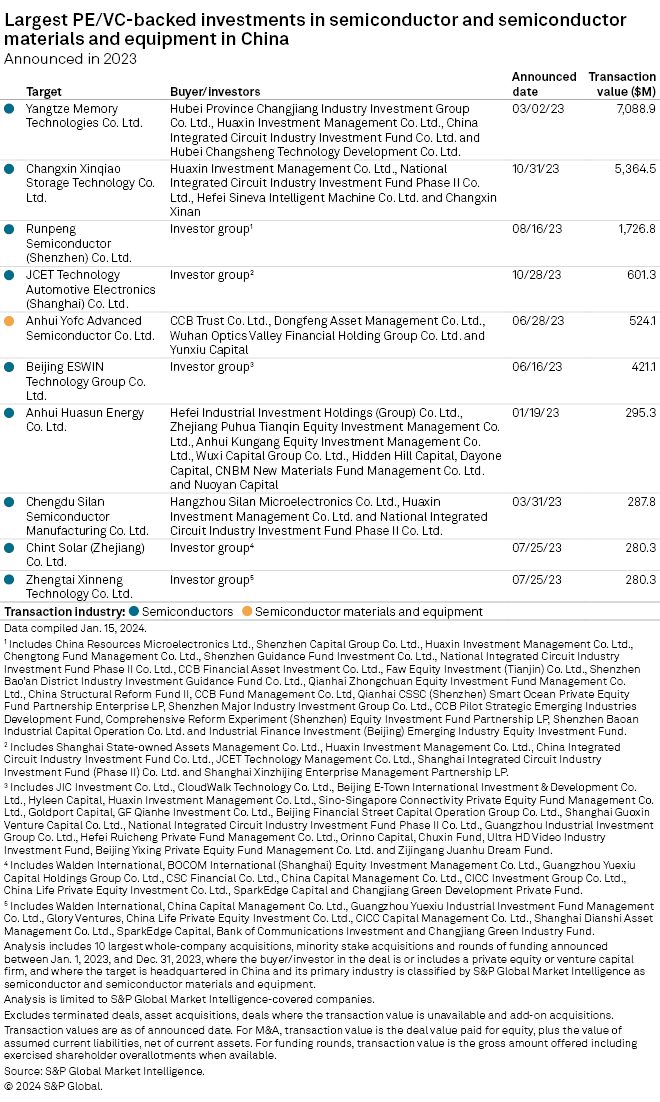

Largest deals in mainland China

The top 10 chip sector deals in 2023 were clearly dominated by mainland China’s domestic private equity and institutional investors. Topping the list was the funding round held by Yangtze Memory Technologies Co. Ltd. for over $7 billion. Investors include Huaxin Investment Management Co. Ltd. and Hubei Province Changjiang Industry Investment Group Co. Ltd.

It was followed by the $5.36 billion funding round of Changxin Xinqiao Storage Technology Co. Ltd.

US investment pullback

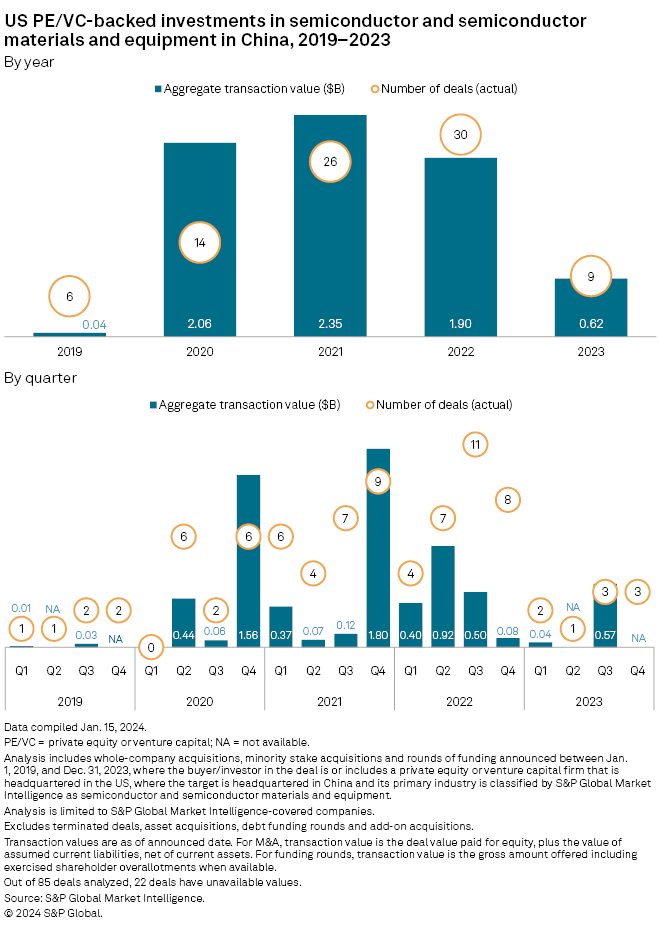

US private equity and venture capital investments in mainland China’s chip industry have been on a multiyear decline following US government restrictions on investments in and exports of sensitive technologies, which includes leading-edge semiconductors and equipment.

In 2023, the value of US private equity-backed deals plunged year over year by more than half to $620 million, the lowest annual total since 2019, the data shows. The number of deals fell to nine transactions from 30.

Foreign investments in mainland China’s semiconductor sector have dropped significantly, and “the trend is likely to continue,” said 451 principal research analyst John Abbott. Potential alternative sources of capital now include domestic government investment and collaborations with friendly Association of Southeast Asian Nation countries.

Efforts to reduce dependencies on foreign technology are underway in both mainland China and the US, Abbott said.