The business services sector has been well liked by investors because of recurring revenue and a belief that many parts of business services are recession resistant. These companies previously offered an element of hope in an otherwise challenged middle market, but the new valuation data suggests confidence in the sector isn’t holding up as well as expected.

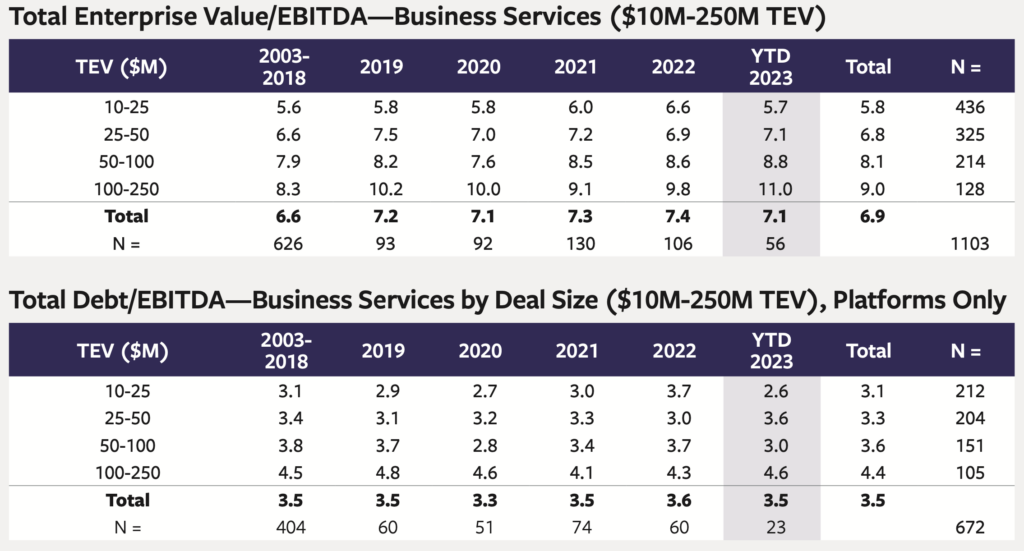

All but the largest transactions in the sector notched declines from the first six months of last year, with cohorts between $10 million and $100 million dropping between 0.4x and 0.9x compared to the three quarters ended Sept. 30. Averages on larger transactions valued between $100 million and $250 million improved by nearly a full multiple through the first three quarters compared to the first half—11.0x versus 10.2x.

Overall average valuations on business services deals are still above the historical average of 6.9x, based on the GF Data database.

Debt coverage on business services platforms also declined through last year’s third quarter. Total debt to EBITDA for these deals averaged 3.5x through the third quarter—in line with the historical average—and below the 3.8x average for the first half of 2023. Meanwhile, senior debt to EBITDA fell to 2.7x compared to 2.9x in the first half of last year.

The declines in coverage most affected smaller platform buyouts valued between $10 million and $25 million and, to a lesser degree, deals valued between $50 million and $100 million.

Bailey McCann is a business writer and author based in New York.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.