S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Private equity’s use of earnouts rose in 2023 as fund managers sought creative solutions to close deals during an M&A slowdown.

M&A deals with earnout provisions had total announced value of $73.11 billion globally in 2023, according to S&P Global Market Intelligence data. Of that total, earnout deals linked to private equity or venture capital firms accounted for 26.5%, or $19.36 billion, their highest share since 2020.

Earnouts are a tool for bridging the valuation gap, or the difference between what a buyer is willing to pay for an M&A target and what the seller thinks it is worth. Earnout provisions guarantee the seller additional future compensation only if the company hits agreed-upon performance targets.

The rise in private equity earnout provisions in 2023 stems from mounting pressure on fund managers to produce exits. Portfolio company hold times lengthened in 2023 as exit opportunities dried up, setting up a domino effect that cut distributions to investors, who then had less cash on hand to commit to new funds, slowing the pace of private equity fundraising.

Read more about private equity’s use of earnouts to navigate a challenging dealmaking environment.

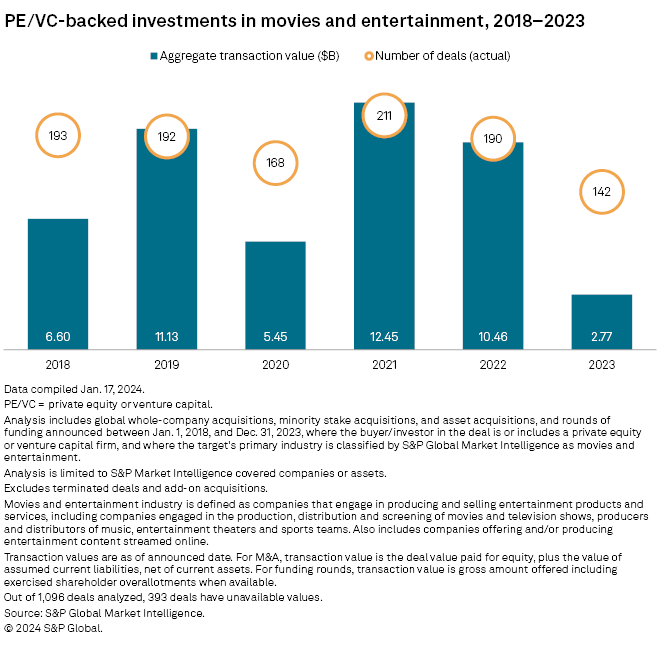

CHART OF THE WEEK: PE investment in movies and entertainment sank in 2023

⮞ The announced value of private equity and venture capital-backed investments in movies and entertainment totaled just $2.77 billion globally in 2023, declining 73.5% from $10.46 billion in 2022, according to Market Intelligence data.

⮞ Private equity has historically been a prominent source of funding for independent films, but it is becoming harder for those films to turn a profit as distribution shifts from theaters to online streaming services, said Wade Holden, senior research analyst at Market Intelligence.

⮞ Other factors behind the decline in investment in movies and entertainment may include high interest rates, weakness in the advertising market and regulatory impediments.

TOP DEALS AND FUNDRAISING

– An H.I.G. Capital LLC affiliate closed its take-private acquisition of specialist delivery service provider DX (Group) PLC for £307 million.

– KKR & Co. Inc. secured $6.4 billion at the final close of its KKR Asia Pacific Infrastructure Investors II SCSp fund. More than half of the fund was already invested or committed.

– TJC LP raised $6.85 billion for The Resolute Fund VI LP at closing. The fund will invest $100 million to $2 billion in companies across various sectors.

– KSL Advisors LLC, or KSL Capital Partners LLC, pulled in more than $3 billion for a single-asset continuation fund for ski resort company Alterra Mountain Co. at final close.

– PPM America Capital Partners LLC raised $660 million at the final close of its eighth coinvestment fund. The PPM America Private Equity Fund VIII LP fund seeks to make about 50 coinvestments ranging between $10 million and $25 million.

MIDDLE-MARKET HIGHLIGHTS

– Bertram Capital Management LLC invested an undisclosed amount in re-roofing and restoration services provider Ridgeline Roofing & Restoration LLC. The target operates in Alabama, Georgia, Tennessee and Florida.

– Newport Global Advisors LP sold casino hotel owner Mesquite Gaming LLC for an undisclosed amount.

– Sterling Partners’ Avathon Capital fund added Magical Beginnings Learning Centers, an operator of early childhood learning centers in the Greater Boston Area, to its portfolio.

FOCUS ON: BIOTECHNOLOGY

– Seed developer Inari Agriculture Inc. raised $103 million in a funding round. Private equity firms Flagship Pioneering Inc. and Rivas Capital LLC participated in the round.

– Cour Pharmaceuticals secured about $105 million in a financing round co-led by Lumira Ventures.

– The National Kidney Foundation’s NKF Innovation Fund made a strategic investment in biomedical company ImmunoFree Inc.

For further private equity deals, read our latest In Play report, which looks at potential private equity-backed M&A, including rumored transactions, each week.