(Bloomberg) — Private equity firms, eager to sell debt-laden businesses, are finding private credit firms increasingly willing to keep outstanding loans intact, even for companies that may soon have new owners.

Most Read from Bloomberg

The trend, known as portability, describes loans that remain essentially unchanged when a company gets new ownership. It carries rewards and risks for businesses and especially for lenders. Usually a change of control would allow lenders to renegotiate terms to cover potential risks from a new parent, such as different plans for growth or profitability of a business.

After two years of rising interest costs hindering asset sales, owners are seizing on recent rate stability to push for portability to get deals done. Keeping the existing loan package in place removes the need for any new buyer to find financing, making the purchase a lot more alluring.

“The market has pivoted to include a portability feature,” said Bill Eckmann, head of principal finance in the Americas and senior managing director at Macquarie Capital. “We’re seeing more of this because sponsors are looking at near-term maturities and thinking about their exits.”

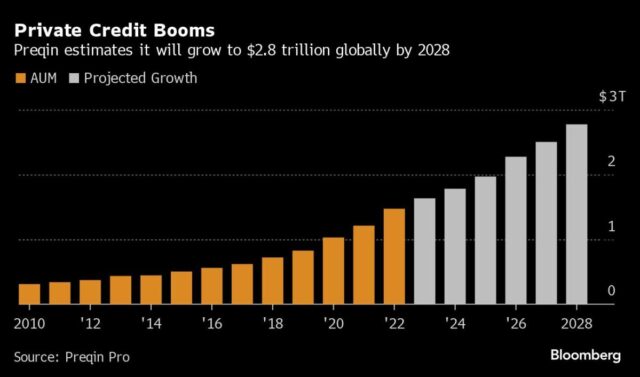

For direct lenders facing rising competition in a market that’s tripled to $1.6 trillion since 2015, portability provisions allow them to stay invested in assets they’ve already vetted and endorsed.

“If you’ve found an attractive business then you may be willing to let the debt travel to another owner,” said Jon Bock, senior managing director at Blackstone Credit. “From a self-selection standpoint, this is an opportunity for managers to extend the lives of the loan.”

Often reserved for strong businesses, portability can avoid the need for a loan to be refinanced in the broadly syndicated market or by a competitor.

Portability Deals

While data showing the total amount of debt with portability features is hard to come by, such provisions are clearly becoming more commonplace.

Veritas Capital, for example, sold its consulting business, Guidehouse Inc., to Bain Capital Private Equity and the company’s $3.1 billion loan package was transferred over. A group of private credit lenders sweetened the terms of their portable facility to entice Bain to keep it in place, rather than risk the chance of losing the loan to a refinancing by banks.

Antares Capital recently led a $1.2 billion portable loan facility to BC Partners’ NAVEX Global, a company the private equity firm has owned since 2018. The proceeds were used to support a dividend recapitalization.

As part of a loan increase provided to AWP Safety last year for add-on acquisitions, direct lenders agreed to AWP owner Kohlberg & Co.’s request for a portability provision, according to a person familiar with the matter. The business has been owned by Kohlberg since 2020.

Kohlberg declined to comment. AWP didn’t respond to a request for comment.

Good Terms

Sponsors recognize the benefits to maintaining loan terms or leverage levels that were given in an era of cheap money and are often unavailable now.

“In some transactions, portability is quite valuable to sponsors because it removes market risk both in terms of leverage and pricing,” said Salman Mukhtar, a managing director at Barings. “It’s a powerful tool in terms of getting leverage and terms that might not be supported by the market in the future.”

In a $2.25 billion refinancing last year for Enverus Inc., the debt was made portable by lenders Hellman & Friedman and Genstar Capital, an investor in the business since 2018.

Not For All

Despite the recent popularity, portability provisions still face hurdles. Some direct lenders simply don’t accept losing the ability to renegotiate terms if a business underperforms or its industry loses luster.

And granting portability to a sponsor without awareness of who its successor will be can raise a red flag.

“Portability isn’t something direct lenders want in documentation because you never know who the company might be sold to, what the strategy will be, what changes will be made or if the management team will stay in place,” said Carolyn Hastings, a partner in the private credit group within Bain Capital Credit. “There’s always a risk that a new buyer might not support the business, should things goes sideways.”

So private credit firms are taking steps to restore the balance of power. When agreeing to add a portability feature, some direct lenders stipulate a list of approved next buyers, leaving out any that make them uncomfortable.

“When negotiating portability, sometimes you have to outline buyers and potential buyers to ensure a company goes to a collaborative partner in a transaction,” Hastings said.

Deals

-

Franklin Energy Services is looking to sell $125 million of preferred equity that would replace existing junior debt, part of an effort to get ahead of upcoming maturities and deleverage the business

-

Texas Capital Bank and Chambers Energy Management led a $825 million private senior secured term loan to Mach Natural Resources LP as part of its acquisition of several oil and gas assets from Paloma Partners Management

-

Adams Street Partners served as lead arranger on a financing package totaling nearly $700 million for private equity firm The Jordan Company’s acquisition of medical device manufacturer Tidi Products

-

Golub Capital led a private unitranche loan of about $2.3 billion to Enverus, a company that provides data and analytics for the energy and power industries

-

Blackstone Inc. and Vista Equity Partners are in talks with private credit lenders to finance their purchase of simulation-software firm Energy Exemplar with a roughly $350 million debt package

-

Bridgepoint Group PLC has reinvested in portfolio company media group Private Equity International and refinanced its debt with a $410 million package

-

Warburg Pincus turned to investment giant Apollo Global Management Inc. for a $1 billion loan to pay down bank facilities involving an older fund

Fundraising

-

The California State Teachers’ Retirement System is seeing its appetite for growth in the hot market dimming as the outlook for interest rates shifts lower

-

Morgan Stanley is discussing allocating a portion of its balance sheet into a new private credit fund that would include capital from external investors

Job Moves

Did You Miss?

-

Credit Crunch Podcast: The Conversations and Quotes From 2023

-

2024 Banks Outlook, Private-Debt Tourists: Credit Edge Podcast

-

Why Wall Street Is Rushing Into Private Credit Market (Video)

-

Private Credit Growth Should Be Welcomed and Watched: Editorial

-

JPMorgan, Citi Are Copying From the Private-Credit Playbook

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.