S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

The numbers are in on private equity’s 2023 fundraising performance, and they show that investor commitments to funds fell to their lowest level since 2017.

The poor showing is a symptom of private equity’s strained investment cycle. Exits from portfolio company investments have been relatively scarce over the past two years — at least compared to the record levels achieved in 2021 — throttling the flow of distributions back to investors.

It has been repeated ad nauseam since early 2022 when the private equity flywheel first began to wobble, but fewer distributions to investors means those investors have less cash to commit to new private equity funds. It does not help that some very important limited partners, namely global pension funds, are already over their targets for private equity allocations.

On an annual basis, private equity’s 2023 exit total showed little to no growth over 2022. But parse the data on a quarterly basis and you will find signs of an exit rebound: After declining in every quarter of 2022, global private equity exit totals followed the opposite trajectory in 2023, climbing higher in every quarter. That is one reason to be more optimistic about private equity fundraising in 2024.

Read more about private equity’s 2023 fundraising decline.

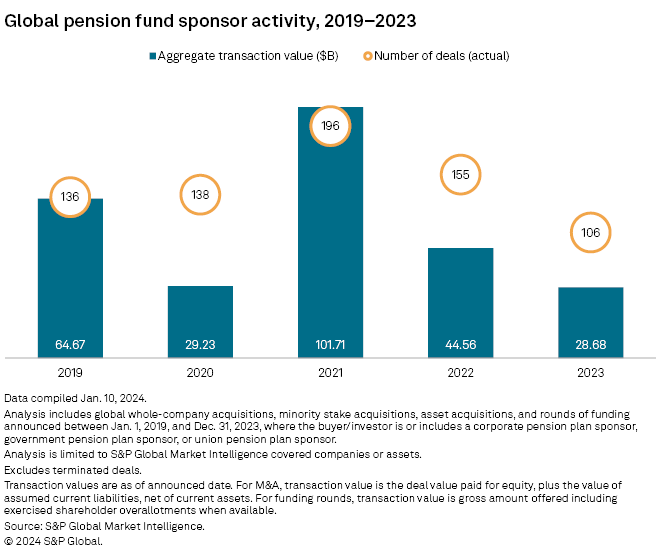

CHART OF THE WEEK: Pension funds’ declining deal activity

⮞ The value of pension fund-backed deals globally fell by more than one-third in 2023 to $28.68 billion from $44.56 billion in 2022, according to S&P Global Market Intelligence data.

⮞ The fourth quarter of 2023 was a particularly quiet one for transactions that have direct pension fund involvement, with just $2.66 billion in deals recorded globally, down nearly 79% from the corresponding quarter in 2022.

⮞ Canada Pension Plan Investment Board participated in the largest pension fund-backed deal of the fourth quarter, partnering with Blackstone Inc. to acquire a minority stake in a senior mortgage loan portfolio once held by Signature Bank, which shut down in March 2023.

TOP DEALS AND FUNDRAISING

– General Atlantic Service Co. LP agreed to buy private equity firm Actis LLP. The target will become the sustainable infrastructure arm within General Atlantic’s global investment platform.

– AE Industrial Partners LP sold specialty materials manufacturer American Pacific Corp. to NewMarket Corp. in a cash deal valued at $700 million.

– Pantheon Ventures (UK) LLP raised $5.3 billion in commitments at the final close of Pantheon Global Infrastructure Fund IV and associated vehicles. The fund will focus on infrastructure secondaries.

– Middle-market investor Windjammer Capital Investors LLC closed Windjammer Capital Fund VI LP at its $1.3 billion hard cap, raising 48% more than its predecessor fund.

– Bertram Capital Management LLC closed Bertram Capital V LP at its $1.5 billion hard cap, exceeding the $1.25 billion target. The fund will invest in the business services, consumer and industrial sectors.

MIDDLE-MARKET HIGHLIGHTS

– TPG Inc.’s middle-market and growth equity platform, TPG Growth LLC, agreed to invest as much as $228 million for a majority stake in counterparty and supply chain risk intelligence provider Sayari Labs Inc.

– McNally Capital LLC sold strategic staffing solutions provider The Re-Sourcing Group LLC to MidOcean Partners LLP.

– CIVC Partners LP acquired data managed services provider Datavail Corp. from a group of growth investors led by Catalyst Investors LLC.

FOCUS ON: SPECIALTY FINANCE

– Panacea Financial LLC, a provider of financial services to doctors and doctors’ practices, secured $24.5 million in a series B funding round led by Valar Ventures LP.

– Berlin-based Infinnity Financial Technologies GmbH, or Pliant, closed its series A financing round at €34 million. Molten Ventures PLC provided new investment in an extension of the series A round.

– InPrime Finserv, which provides affordable credit for informal economy customers in India, pulled in $3 million in a series A round led by Matrix Partners India Advisors LLP.

For further private equity deals, read our latest In Play report, which looks at potential private equity-backed M&A, including rumored transactions, each week.