(By Caixin journalists Qu Yunxu and Denise Jia)

Private equity (PE) and venture capital (VC) investors, once enthralled with China, are now struggling to find new investment strategies — or just the exits — as Chinese stocks extend a three-year slump.

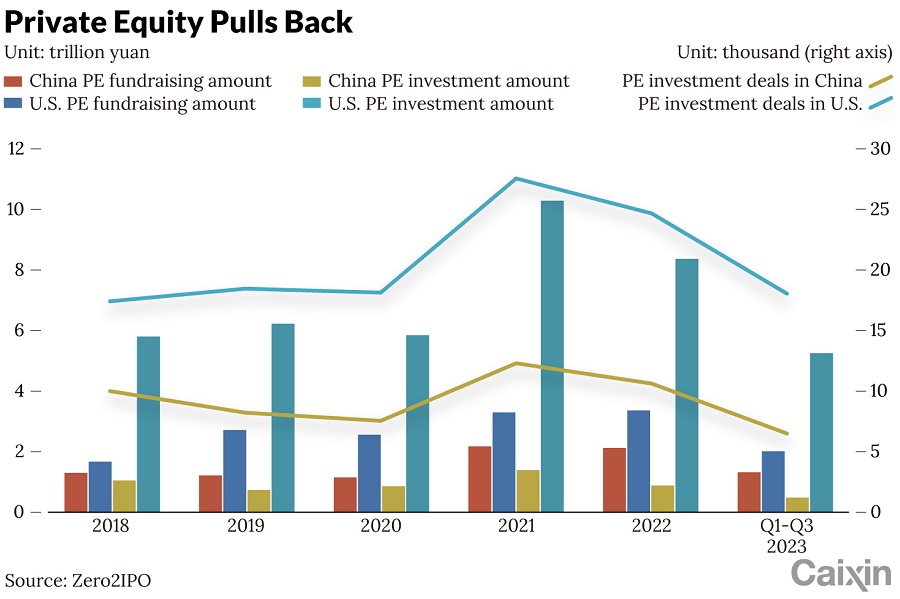

In the first three quarters of 2023, indicators for fundraising, investment and exits by PE and VC firms in the Chinese market all declined, according to equity investment research institution Zero2IPO Group. The number of new funds dropped by 2.1% from a year earlier to 5,344 and the scale of these funds fell 20.2% to 1.35 trillion RMB (US$187 billion).

“After the Spring Festival holiday in 2023, everyone was on the road, expecting a recovery and rally in the market,” said Wang Lixing, managing director of PE firm China Renaissance Holdings Ltd. But by April, when the anticipated rally did not materialise, PE and VC firms’ willingness to make deals declined and the negative trends were reinforced by a string of disappointing economic reports, Wang said.

China’s attractiveness in the global private equity market was further weakened by intensifying geopolitical and ideological conflicts. Investors, especially from the US, have switched from mandated allocations for the Chinese market to caution.

In the first three quarters of 2023, there were only 57 new funds in foreign currency, down 45.2% year-on-year, raising 91.8 billion RMB, a decrease of 59% from the same period in 2022.

During the first nine months of last year, PE funds made 6,510 investment deals in China, down 25.9% from the comparable year-earlier period, according to data from Zero2IPO. The value of those investments dropped 31.8% to 507 billion RMB.

Notably, the mobile internet sector — the hottest segment for PE investment — has lost its appeal. Historically, the scale effect of mobile internet and the characteristics of China’s large, unified market, created miraculous returns for PE and VC investors. But in the past three years, those same investors have taken the view that the high-growth, high-return phase of China’s internet industry has reached an end.

Artificial intelligence and overseas manufacturing are two growth areas, but the investment has mainly come from government-backed industrial capital funds rather than private equity funds.

Meanwhile, no new sectors have emerged as a magnet for capital. With private equity in retreat, central state-owned enterprises (SOEs) and local governments have become the main venture investors in China. However, SOEs usually have longer investment decision-making cycles and are cautious about investment in startups in early research and development stages. State-backed investment has poured into sectors supported by national policies such as new energy and semiconductors, rapidly pushing production capacity into excess.

Artificial intelligence and overseas manufacturing are two growth areas, but the investment has mainly come from government-backed industrial capital funds rather than private equity funds.

Exit challenge

China’s three-year stock slump has made it difficult for PE and VC firms to exit their investments. China ended 2023 with the world’s worst-performing equity market as the blue-chip CSI 300 Index fell for the third straight year, plunging 35% over 36 months.

In the 2023 maximum return on investment award released by investment market data provider ChinaVenture, the top award was vacant. In the past three years, no institution in China has achieved an exit deal valued at more than 1 billion RMB from a single investment, a researcher from a PE firm said.

European PE firms now require new investments to include separate exit provisions for foreign capital, such as through buybacks, an Asian head of a European PE firm told Caixin. “How to convince the investment committee that an investment in China can be exited after five years? That’s a problem,” the executive said.

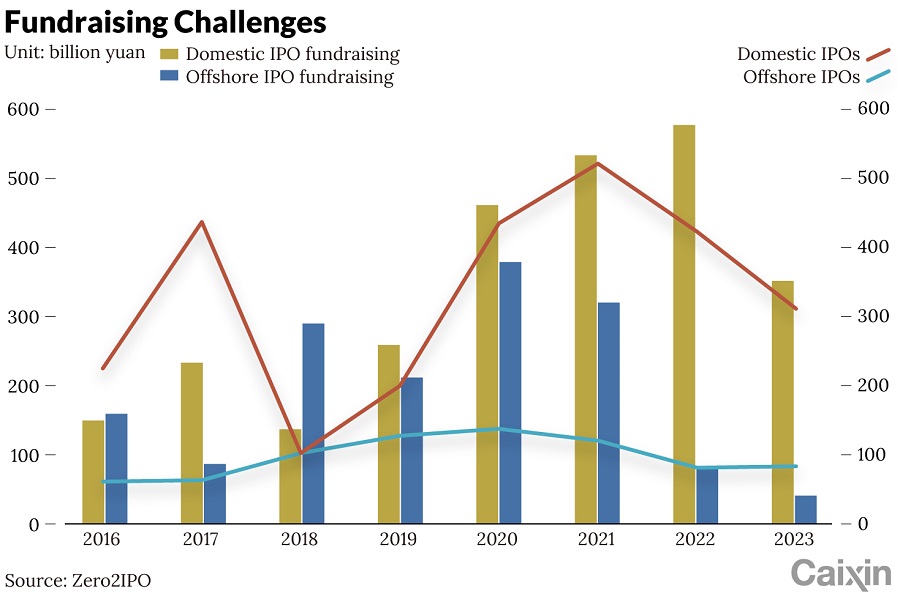

Last year, the Shanghai and Shenzhen stock exchanges approved 245 initial public offerings (IPOs), 38% fewer than the previous year. Only 32 new listings occurred from September through December amid efforts to temporarily slow IPOs in response to market fluctuations. Meanwhile, listings of Chinese mainland firms in Hong Kong last year declined by 10.8% to 66.

Despite depressed valuations, the Hong Kong stock market remains an option for many mainland companies, especially those that are not favored by the A-share market, or face strict cross-border data or cybersecurity reviews for listing in the US.

Hong Kong has been the top destination for IPOs from mainland China for years. But the country’s slower economic growth and prolonged stock-market slump have made it harder for companies to go public.

Only 73 companies went public in Hong Kong last year, raising a total of US$46.3 billion. That represented a 19% decline in new listings from 2022 and 56% drop in capital raised, the lowest level in two decades, making the Hong Kong Stock Exchange rank sixth after the Shanghai Stock Exchange, Shenzhen Stock Exchange, Nasdaq, New York Stock Exchange and National Stock Exchange of India.

Despite depressed valuations, the Hong Kong stock market remains an option for many mainland companies, especially those that are not favoured by the A-share market, or face strict cross-border data or cybersecurity reviews for listing in the US.

The US is still a better IPO destination for larger Chinese companies because of the potential to receive higher valuations on Wall Street, Jiang Ke, managing partner at venture capital investment firm Taihe Capital, told Caixin. The average market cap for A-share listed companies ranges from 5 billion RMB to 10 billion RMB, which means a pre-IPO valuation of 2 billion RMB is the upper limit, Jiang said.

M&A option

Given the challenges facing IPOs, PE investors are often turning to mergers and acquisitions (M&A) for their portfolio companies.

In 2015, China Renaissance promoted the merger of Meituan and Dianping as well as Didi and Kuaidi, which in turn facilitated their subsequent IPO, Wang said. “Potential buyers, under increasing growth pressure, are willing to achieve non-organic growth through acquisition, but they are watching the timing and choosing their targets cautiously,” he said.

For the next two years, PE firms will aim to use S funds [secondary funds] to get through the downward cycle, while direct investment funds continue to increase their investments — Lu Yu, General Manager, Shenzhen Capital Group

M&A deals in China’s tech sector have sharply declined in the past two years. The number of transactions fell 31% last year to 2,791 deals following a 21% decline in 2022. The value of mergers plunged 53% last year to US$271.5 billion, the lowest level in a decade, following a drop of 30% in 2022, according to a report by Firstred Capital, a Beijing-based M&A advisory firm.

PE firms expect M&A deals to increase this year. At Taihe Capital, M&A deals account for a quarter of the firm’s total transactions, Jiang said. Previously, mergers represented less than 10% of deals.

In the past five to six years, nearly three-quarters of China’s family-owned businesses have been facing succession issues. Among A-stock listed family-owned companies, less than a quarter of their founders’ children are willing to take over the family businesses, according to Fang Min, co-head of Warburg Pincus’s private equity investments in China, citing third-party data. Therefore, many entrepreneurs prefer to sell their companies, Fang said.

Turning to secondary funds

In addition to M&A, secondary funds (S funds) and continuation funds have become increasingly active in China’s PE market, as they provide liquidity to PE limited partners. S funds purchase existing interests or assets from primary PE investors. Instead of selling the asset to a third party, continuation funds are typically set up and managed by the same manager selling the assets.

There are more than 370,000 PE funds facing exits or extensions, with about 15 trillion RMB of investments, according to Yuan Ye, managing director and head of general partner/limited partner investments and exit services at CEC Capital, a Beijing-based investment firm.

For the next two years, PE firms will aim to use S funds to get through the downward cycle, while direct investment funds continue to increase their investments, said Lu Yu, general manager of the S Fund investment department at Shenzhen Capital Group.

Du Zhihang, Liu Peilin, Sun Yanran, Feng Yiming also contributed to the story.

This article was first published by Caixin Global as “Cover Story: Private Equity in China Heads for Exits Amid Three-Year Stock Slump”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

Related: Can China’s ailing stock market turn the tide after the Chinese New Year? | China’s three-year stock slump resists policy prescriptions for rebound | [Big read] When will the Chinese stock market thrive again?