The number of global private equity exits remained muted for the second consecutive year in 2023 despite signs of improving conditions for sales to corporate strategics and IPOs.

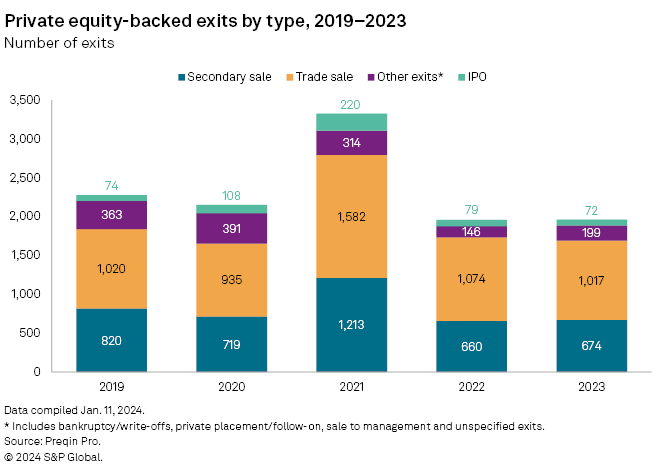

Global exit totals were nearly unchanged year over year, with Preqin recording 1,962 private equity exits in 2023 compared with 1,959 in 2022, when inflation and interest rate hikes slammed shut the IPO window and an uncertain economic outlook dampened M&A activity.

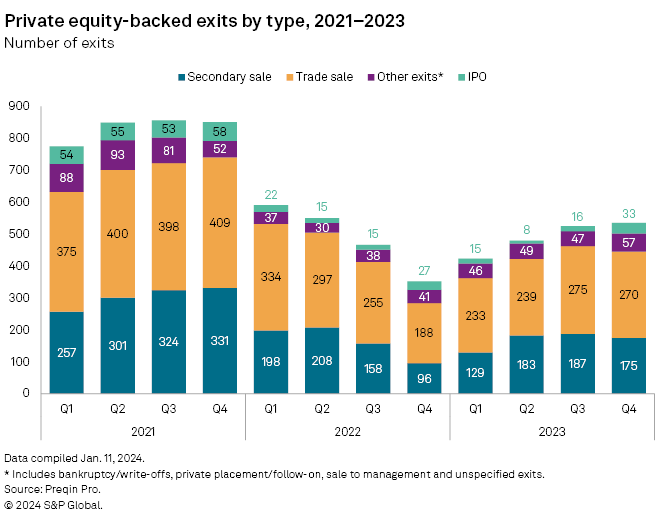

But while exits declined in each quarter of 2022 — bottoming out in the fourth quarter — the opposite was true in 2023, with exit totals building quarter by quarter.

That momentum is expected to carry over to 2024 as private equity fund managers come to terms with portfolio company valuations dented by higher-for-longer interest rates and slower economic growth, said Andrea Guerzoni, EY global vice chair for strategy and transactions. Guerzoni said EY registered an uptick in pre-exit activity in recent months.

“The progressive normalization of inflation and interest rates has created over the last couple of months a much more fertile ground for exits,” Guerzoni said.

IPOs scarce

Global markets saw just 72 IPOs by private equity-backed companies in 2023, the lowest total since at least 2019, according to Preqin. As in 2022, trade sales of portfolio companies to strategic acquirers accounted for more than half of all private equity exits in 2023.

Guerzoni said a significant near-term increase in IPOs appeared unlikely. But the executive’s predictions for 2024 included an uptick in dual-track exit processes, in which a private equity firm simultaneously pursues an IPO and a trade sale. That strategy allows a fund manager to continue planning an IPO while keeping open the opportunity for a motivated buyer to put a stronger offer on the table.

– Download the raw data file for this story.

– Read about the 2023 decline in VC investments.

– Catch up on private equity dealmaking trends.

Link to fundraising

Boosting exits is widely seen as one way to improve private equity fundraising, which tumbled to a six-year low in 2023. Law firm Dechert LLP noted in a global private equity report issued late last year that the slower pace of exits “has caused distributions to slow, leaving [limited partners] with less cash to recycle into new funds.”

KKR & Co. Inc. Co-CEO Scott Nuttall told a conference audience in December that he saw conditions for exits, including IPOs, improving in 2024 — a positive sign for the firm’s fundraising goals.

“In terms of monetizations, as the IPO markets open up, as the markets go up and strategic buyers come back, I think you’ll see [exits] move up, too. Our hope and expectation is that will likely correlate with around the time we’re coming back to these flagship funds,” Nuttall said.

Largest exits of 2023

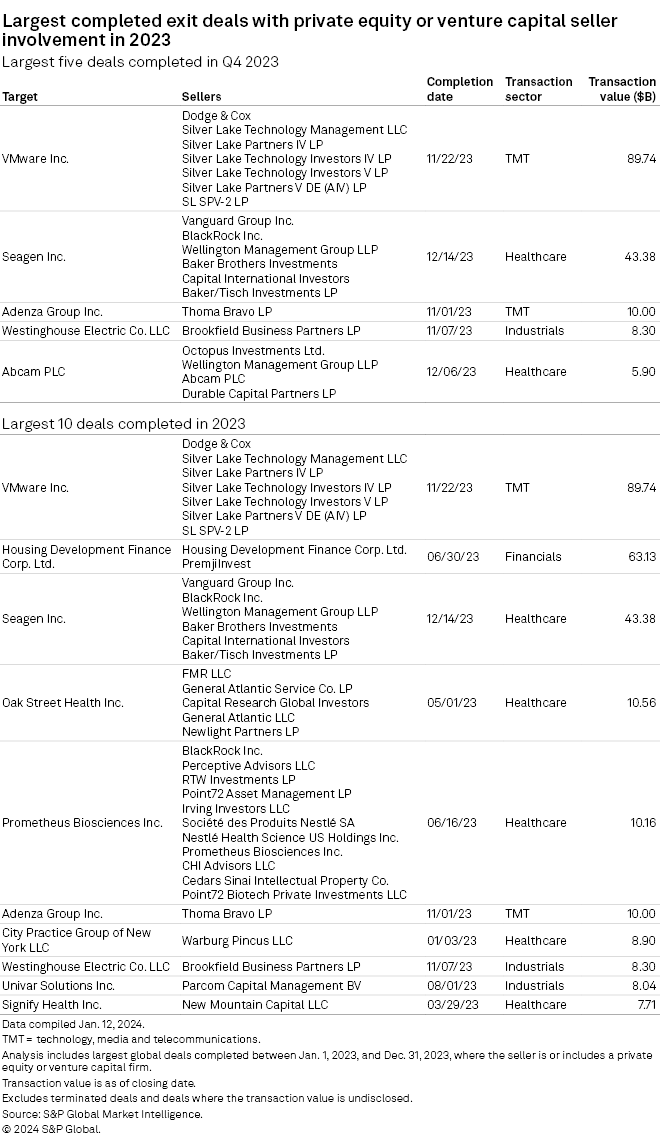

Trade sales and sponsor-to-sponsor deals dominated the largest exits of the year. None of the top 10 largest private equity exits in 2023 came via IPO.

The largest exit of the year was the $89.74 billion sale of cloud-computing firm VMware Inc. to strategic acquirer Broadcom Inc. by a group of investors, including Silver Lake Technology Management LLC and Dodge & Cox, according to S&P Global Market Intelligence data. The deal was originally announced in 2022 but its closing was repeatedly delayed.

Venture capital investor Y Combinator managed 30 exits from portfolio company investments in 2023, more than any other private equity firm globally, according to Market Intelligence data.