The private equity industry thrives on international talent: post-pandemic it’s increasingly common to see executives change residence from one European city to another for both professional and personal reasons.

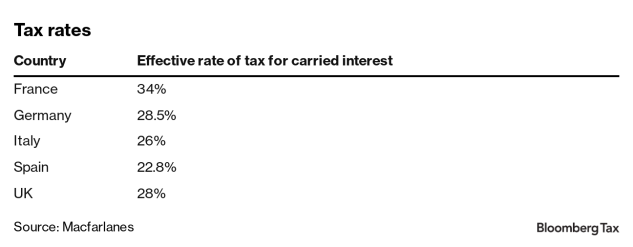

Such moves can give rise to a range of tax issues, especially in relation to carried interest. The European countries with major financial centers all tax carried interest, or “carry,” at similar rates, as shown in the table below.

However, there is little consistency in how carried interest is characterized. This means some cross-border moves can lead to surprising outcomes.

UK Perspective

Consider a self-employed executive who holds carry directly in a private equity fund that is a transparent partnership. The carry is paid out of capital gains, and the UK disguised investment management fees rules and income based carried interest rules don’t apply.

The UK only taxes carried interest capital gains received by current UK residents, irrespective of whether the recipient was UK resident when the carried interest was first awarded or vested.

When a carry-holding executive leaves the UK, the position is therefore relatively straightforward. The UK ceases to exercise taxing rights at the point of departure, and the executive should only be taxed in their new country of residence provided they don’t return to the UK in time to trigger the UK’s temporary nonresident rules.

Tax treaties based on the OECD model generally give a person’s state of residence the sole right to tax their capital gains. One might therefore expect that when an individual migrates to the UK from a country with which the UK has a double tax treaty, there would also be no possibility of double taxation—the UK’s domestic charging rule is aligned to the division of taxing rights under the treaty.

In reality, matters are often more complicated.

Different characterizations. Carried interest that the UK regards as a capital gain can be characterized as investment income or even earned/employment income in other countries—this can be the case in Germany, Italy, Spain, and Sweden. Those countries might assert a right to tax the carried interest even after the recipient has ceased to be resident.

Spain, for example, treats carry distributions as employment income—with a 50% exemption where the Spanish carry regime applies. Spain will seek to tax post-migration carry distributions that are attributable to activities undertaken pre-migration, for example, where the individual performed investment management services in Spain during the vesting period.

That might seem surprising from a UK perspective. However, tax treaties generally permit source country taxation in this situation.

That’s because when determining which treaty article a payment falls within, if there isn’t an explicit provision in the treaty the definitions article (article 3(2) of the Organization for Economic Development and Cooperation Model Tax Convention) defers to the characterization applied by the state that’s seeking to tax the payment.

From Spain’s perspective, carried interest is employment income and therefore is subject to the employment income article of the UK–Spain Double Tax Convention. That article permits Spain to tax amounts—in this case carried interest—arising to a UK resident to the extent they are derived from employment in Spain.

The UK will seek to tax the same amounts. From the UK’s perspective it’s permitted to do this by the capital gains article of the double tax convention. However, both UK domestic legislation and the treaty allow credit relief from capital gains tax for any Spanish tax paid on the same item of gain.

Credit relief should generally therefore be available in the UK for the Spanish employment tax up to the amount of UK tax due—although this must be claimed.

Other Issues

Even where there is no conflict of characterization, it’s possible carried interest may be taxed in two countries.

Exit taxes. Countries such as Germany and France sometimes tax emigrating individuals on the unrealized appreciation in the value of their carry when they depart. The UK’s CGT rules quantify carried interest gains by reference to the original cost of the carry, and not the value at the point the individual became UK resident.

In these exit tax situations, therefore, the gain taxed on migration in the country of departure will be taxed again in the UK when the carried interest is realized (subject to credit relief).

Holding companies. Two layers of taxation will arise if an individual holds their carry in a company, which is typical in Sweden and the Netherlands. The company will pay tax on the carry when it first pays out and then there will be further UK taxation when the proceeds are extracted—a dividend would be subject to income tax at 39.35%.

These two layers of taxation apply to any company’s profits; however, they would lead to an effective tax rate that is higher than the headline 28% CGT rate.

These issues can arise in combination. For example, we understand that executives migrating from the Netherlands face an exit charge on any unrealized appreciation in value of their holding company’s shares. It isn’t clear whether that tax would be creditable against the executive’s UK tax liability when the carry pays out or a dividend is paid—which are separate items of income.

This type of holding structure could therefore lead to unrelieved double taxation. Migrating executives in this position should consider whether a company remains the right holding structure post-migration.

Be Aware of Obligations

These examples give just a flavor of the issues that migrating PE executives might face. It is hard to draw any general principles given the lack of commonality in European countries’ approaches—every migration must be examined based on the individual’s facts and the countries involved.

For many individuals, the UK’s non-dom tax regime—or, from April 6, 2025, the new tax regime for foreign income and gains announced at Spring Budget 2024—may assist by taking their pre-migration carry out of scope of UK tax. However, this isn’t a panacea. Mobile executives should be alert to the possibility of continuing tax obligations in their country of departure post-migration and the need to claim credit relief in the UK.

This article does not necessarily reflect the opinion of Bloomberg Industry Group, Inc., the publisher of Bloomberg Law and Bloomberg Tax, or its owners.

Author Information

Bezhan Salehy is a tax policy specialist in the Macfarlanes tax and reward group, advising clients on the latest tax policy developments. He previously worked at HM Treasury and HM Revenue & Customs.

Elvira Colomer Fatjó is an associate in the Macfarlanes tax and reward group. She advises clients on a broad range of UK and cross-border tax matters.

Write for Us: Author Guidelines