Hi, it’s Madeline. Let’s get into it.

The Main Item

Rarely has the financial world been as focused on a single company’s quarterly results as it was on Nvidia’s this week. And rarely has a massive company delivered in such spectacular fashion, with CEO Jensen Huang telling investors that “accelerated computing and generative AI have hit the tipping point,” with only blue sky ahead.

For AI chip startups and the growing ecosystem of companies that provide AI compute horsepower and services, this was all great news insofar as it confirmed extraordinary demand among the many companies pouring money into training and deploying generative AI models.

Hardware startups like Rain AI — which is building chips to compete with Nvidia and boasts a personal investment from Open AI CEO Sam Altman — look more promising than ever. So do firms like Together AI, which helps companies fine-tune their models so they don’t need to spend so much on buying or renting costly chips; Eric covered the firm’s funding round in November, and now the company is raising fresh funds at a $1 billion valuation, The Information reported.

And ambitious new entrants are still joining the party: Recogni, the autonomous vehicle startup, announced just this week that it had expanded its focus into designing chips for generative AI, and had raised a new $102.5 million Series C.

Still, all sorts of hazards lurk in the AI chip boom. For one thing, even with Nvidia’s extraordinary growth most expect the shortage of GPUs to ease eventually (and it may in fact already be happening) which could squeeze startups that resell access to those chips. Some of these have already faced turmoil: The Information reported in early February that GPU reseller Banana was shutting down its main business and pivoting the focus of the company.

Further, the chip industry is notoriously cyclical, and many AI businesses remain fundamentally unproven—leaving open the possibility that an eventual slowdown will send chip prices in the opposite direction.

Databricks’ Ali Ghodsi told The Information in a Q&A two weeks ago that the chip demand for AI startups mirrors the early 2000s demand for bandwidth from early internet companies, where markets eventually caught up and prices became more affordable.

“It turned out that actually capitalism, supply and demand takes care of the problem and the price of bandwidth just plummeted and bandwidth was abundant everywhere. The same thing will happen with GPUs,” Ghodsi said.

That’s hardly a consensus view, of course. Altman, who has mooted a desire to raise trillions for a chip venture, isn’t buying it. Neither is Softbank’s Masayoshi Son, who Bloomberg reported is looking to raise $100 billion for a chip initiative that would complement its holdings in ARM and compete with Nvidia.

And Nvidia can’t be too worried for the moment, not after reporting 265% annual revenue growth and seeing its market cap increase by $277 billion on Thursday, the largest single-day gain in history. Nvidia generated $24 billion in revenue in the fourth quarter, above the $21.9 billion analysts had predicted, according to Bloomberg. Nvidia’s market cap crossed $2 trillion this morning.

Newcomer Banking Summit

We’re entering the home stretch ahead of the Newcomer Banking Summit on March 14 in San Francisco. It will bring together some of Silicon Valley’s top fintech founders and investors, along with top tech bankers and financial executives. The event is invite-only but please fill out this form if you’re interested in attending.

Silicon Valley Bank President Marc Cadieux will speak around the one year anniversary of the SVB crisis. Mercury CEO Immad Akhund and Lead Bank CEO Jackie Reses are also among our speakers at the one-day event.

One Big Chart

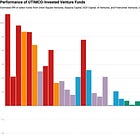

Yesterday we published data on top venture funds, including Sequoia and Union Square Ventures, gathered from a public records request to UTIMCO, the investment managers for Texas’ two big public universities.

Here’s a chart of 5 top VC funds’ internal rate-of-return (IRR), divided by vintage and year.

You can read more and see more VC returns compared over the years 2020-2023 here.