For coffee chains, 2023 was a landmark year, with at least two specialty coffee retail ventures securing significant fund infusions in the specialty coffee startup ecosystem.

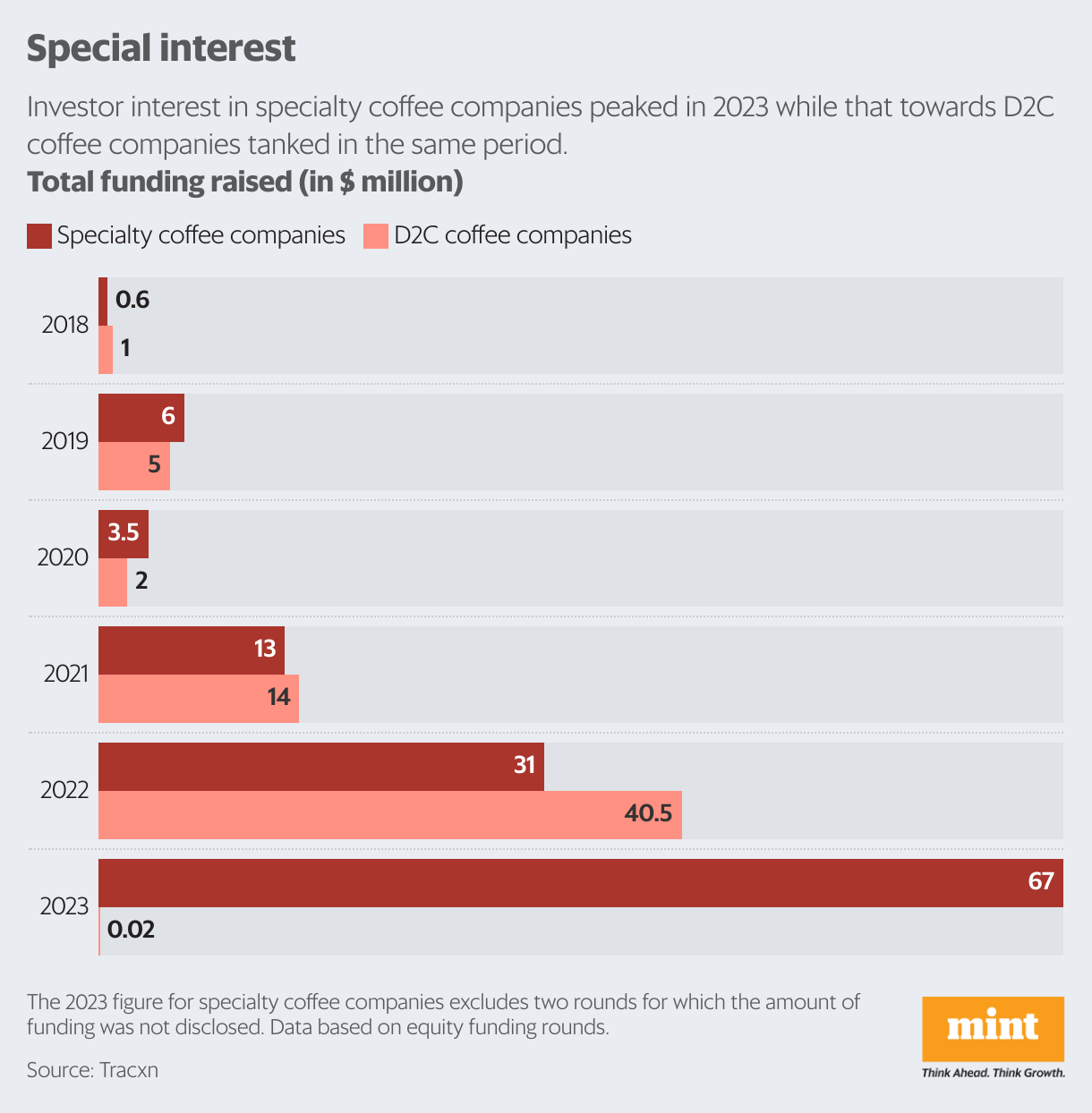

This is reflected in data—Indian specialty coffee café chains have raised close to $100 million venture capital in the last two years, compared with a cumulative $22 million in the fours years before that, according to Tracxn.

This is because of the growing coffee consumption in India and falling cost of capital expenditure, investors said.

Over the years, the real bane of the business has been high retail cost, said V. T. Bhardwaj, partner, A91 Partners, an investor in specialty coffee retail chain Blue Tokai. “The capex you invested in a cafe was never great, it was acceptable but not good. For every one rupee you put, you maybe will get a 2x return in three years. The cost of capex has come down because there are more people interested,” Bharadwaj said.

Specialty coffee as a product was also unknown previously, Shivam Shahi, co-founder and chief operating officer, Blue Tokai, said.

In the last two years, the perception started shifting, and investors have started giving importance to retail, he said.

“The perceived value of the category has gone very high because of the growth coffee is seeing as a category,” Shahi said.

Blue Tokai has about 90 cafes across India, according to its website. Its physical cafes account for 65–70% of the overall revenue, while the rest comes from the online segment, according to Shahi.

Last year, it raised $30 million in a round led by A91 partners, in addition to an undisclosed round from film actor Deepika Padukone. Another specialty coffee chain, Third Wave Coffee, secured $35 million in a Series C funding round, led by investment firm Creaegis. During the same period, coffee chain AB Coffee raised a seed round and Hatti Kaapi scooped up an undisclosed round last year, according to data from Tracxn.

Data platform Statista estimates the Indian coffee market to be worth $0.5 billion in 2023, which is expected to grow at a compounded annual growth rate of 9.04% till 2028. The specialty market represents about 5% of the formal coffee market, according to the 2021–22 annual report of Tata Consumer Products.

Investor interest in coffee is not new. Several coffee chains, including Starbucks, Barista, and Café Coffee Day have been trying to succeed in India over the last decade.

Starbucks entered India in 2012 and operates about 390 stores, or cafés, in the country through a joint venture with the Tata Group. A Reuters report says the coffee retail giant plans to operate 1,000 stores in India in the next four years. Starbucks reported a loss of ₹25 crore and revenue of a little over ₹1,000 crore in FY23. In 2014, Italian group Lavazza Spa sold Barista to New Delhi-based Carnation Hospitality for ₹100 crore after failing to turn the group around. Coffee Day slid into bankruptcy in 2023.

The recent breakthrough has been the entry of delivery, Bharadwaj said. “Almost 20–30% of business for these startups is coming from delivery. Economics of the business have improved because of that. Earlier, if you had invested ₹10 lakh in a café, you would get ₹20 lakh, contribution margin was 60%. Now you would get ₹30 lakh with the same setup because of delivery,” he added.

Blue Tokai’s revenue surged 80% on year to ₹74 crore in FY22, while its loss widened to ₹12 crore from ₹7 crore. At the same time, Third Wave Coffee revenue saw a near threefold jump from FY21 to ₹32.5 crore in FY22. Its loss stood at ₹14.5 crore during the same period.

Investors are pouring money into speciality coffee cafe startups, while the investor sentiment isn’t particularly bullish on D2C coffee brands without any retail presence.

Many companies cropped up in the D2C coffee brands space in the past, as the thesis was that getting rid of retail costs would help the sustainability of the business. But things haven’t panned out as was imagined because of high customer-acquisition costs and stiff competition, according to Rahul Jain, cofounder of D2C coffee brand Beanly.

“We have seen that people are looking for brands that have a holistic presence with multiple channels and not just D2C. Physical presence helps with brand recall, more people recognising you and trying your product, and building retention,” he said.

Jain said that investor sentiment for any consumer product brand, which is purely D2C, is slightly negative.

Premium coffee is expensive in India, says Bhardwaj of A91 Partners. “Customers are not willing to pay for sitting at home. When many cafes will open, people will get used to it and then they may become willing to spend on good coffee at home, then the D2C premium coffee market will gain traction,” he said.

It is also not just about coffee. “There’s also food that these cafes serve with coffee. It’s essentially a food business,” he added.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Download The Mint News App to get Daily Market Updates.

Published: 14 Jan 2024, 10:52 PM IST