Like us, our southern neighbor had a tough year for venture capital investment in 2023.

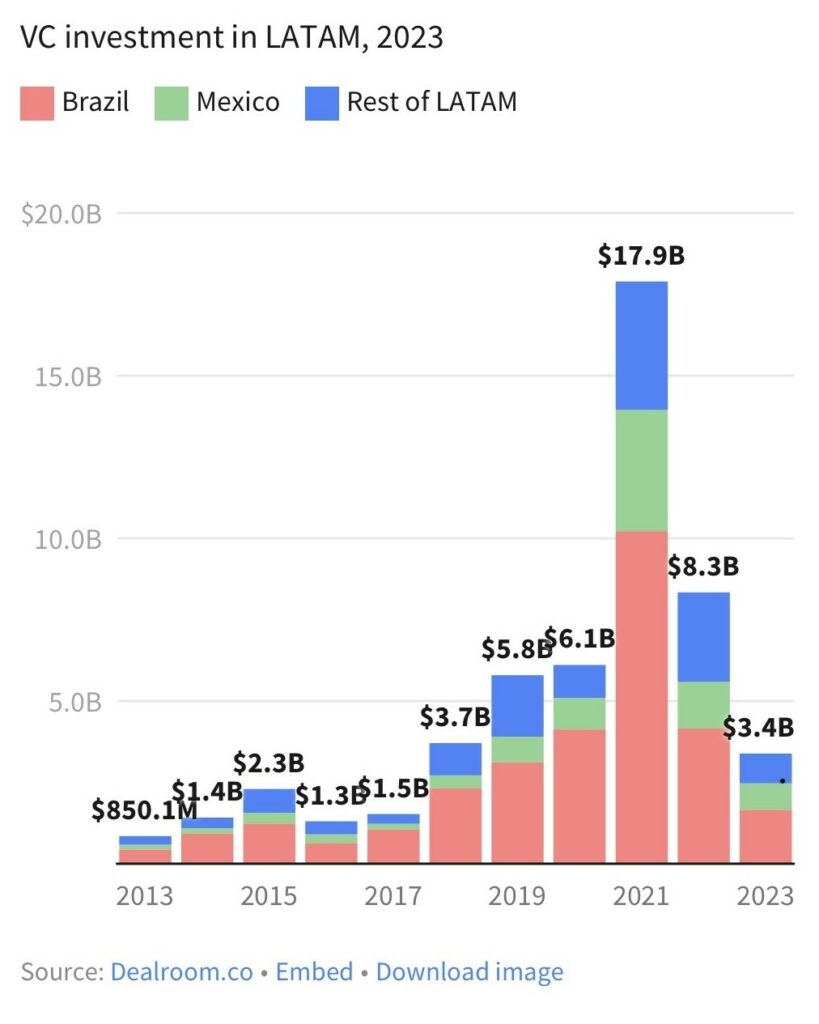

VC investment in Latin America plummeted compared to its rocketship high in 2021 and is down 60% from its results in 2022, its second highest level 2022, according to a Dealroom briefing. In total, $3.4 billion raised by LatAm startups – and SaaS startups made up 2/3 of that – but it was the lowest level of VC investment in the region since 2017.

One of the primary reasons for the 60% drop – which was very similar to Miami’s – is because of the sharp decline in megarounds, with only 4 in 2023. That’s also a trend we saw in Miami, which I will report on soon.

Regional leaders: According to Dealroom, Brazil remains the leader in VC, with its startups raising $1.7B in 2023, yet falling 60% from 2022 levels. The country’s startups produced two megarounds, compared to 10 in 2022

Mexican startups raised $811M in 2023, down 43% from 2022. Notable funding rounds in fintech startups include Bankaool and Clara as well as emerging EdTech platform Talisis.

Chile overtook Colombia to become the third-most invested in country in LATAM, raising $320M in 2023. Chile fell by 32%; breakout rounds included Galgo, FZ Sports (also in Miami) and Buk.

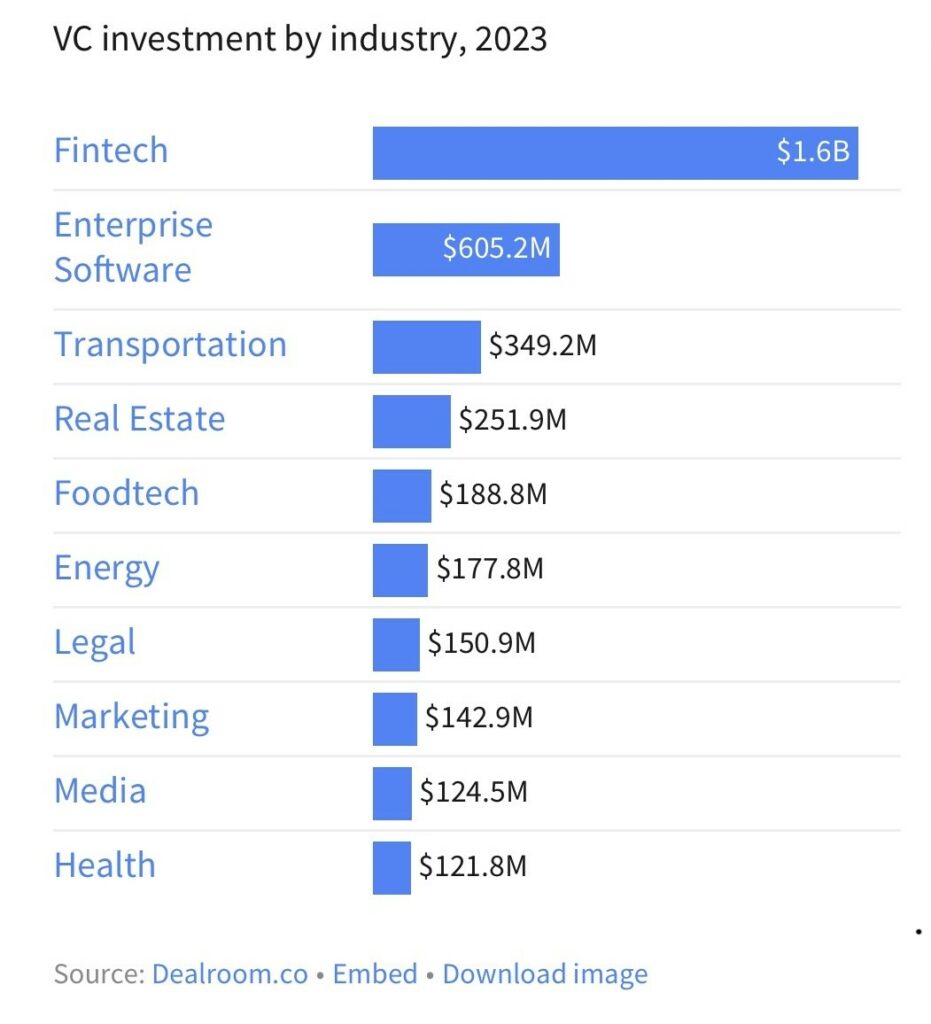

Fintech is king: In another trend that is very similar to Miami, fintech remains the top sector by VC investment in LatAm [see chart below]. The $1.6 billion raised accounts for 40% of VC investment in 2023. Three of the four total megarounds into LatAm were in the fintech sector too. in 2023. Still, fintech investment in 2023 fell by 66% compared to 2022.

Miami connection: The number of LatAm founders in Miami is large and growing, but there are VC connections too. In 2023 Marcelo Claure and Shu Nyatta announced the launch of their inaugural $500 million fund for Bicycle Capital, a new growth equity firm focused on the region. Claure and Nyatta helped found and manage SoftBank’s $8B Latin America Funds. That new fund was also part of a positive trend for Latin America VC: Fundraising by VC firms in the region rose by over 40% to reach $2 billion in 2023, Bloomberg reported.

Explore venture capital investment data by industry sectors in LatAm on Dealroom’s platform here. And to follow Miami’s results and trends, check out Refresh Miami’s new Miami Tech Dashboard powered by Dealroom. Stay tuned for my report on Miami venture capital.

READ MORE IN REFRESH MIAMI:

- By the numbers: LatAm VC in 2023 – January 4, 2024

- 6+ things to know in #MiamiTech: What were 2023’s top-read stories? Plus news from Endrock, Maker5, Bird, Venture Miami, Meet the Drapers & more – December 29, 2023

- Bezos, Brightline, AI, a climatetech hub & more: There were many #MiamiTech wins to celebrate in 2023 – December 27, 2023