Global venture capital funding in the energy storage sector in 2023 reached $9.2 billion, a 59% year-over-year (YoY) increase from $5.8 billion. The amount raised was the largest ever.

The numbers were revealed in Mercom Capital Group’s newly released Annual and Q4 2023 Funding and M&A Report for Storage & Grid.

While the total funding rose, the number of deals dropped to 86 from 96.

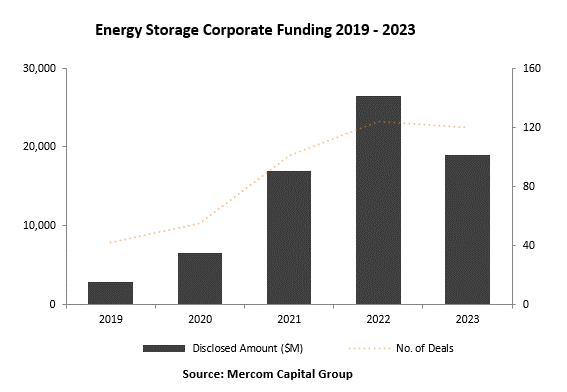

According to the report, corporate funding, encompassing including venture capital (VC) investments, public market funding, and debt financing, saw a 28% YoY decline. A total of $19 billion was raised across 120 deals, marking a decrease from the $26.4 billion raised in 124 deals in 2022. The total funding for 2022 was significantly boosted by LG Energy Solution’s one-off $10.7 billion IPO.

“In 2023, the best-ever recorded amount for venture capital in energy storage was observed. The Investment Tax Credit (ITC) has played a significant role, allowing standalone storage projects to qualify for a 30% credit. Additional incentives, such as advanced manufacturing credits, aimed at promoting manufacturing within the U.S. have also been beneficial,” said Raj Prabhu, CEO of Mercom Capital Group.

In the fourth quarter of 2023, corporate funding for energy storage companies witnessed a 55% quarter-over-quarter (QoQ) drop to $3.7 billion across 26 deals, as opposed to the $8.2 billion raised in 35 deals during Q3. On a YoY comparison, funding dipped 14% compared to the $4.3 billion raised in 31 deals during Q4 2022.

“Corporate funding, encompassing venture capital, public market financing, and debt, saw a decline due to tough market conditions and uncertainty around the interest rate trajectory. Public market and debt financing deals were a lot more sensitive to high-interest rates,” said Prabhu.

In 2023, lithium-ion-based battery technology companies secured the highest amount of VC funding. Other top funded categories comprised battery recycling, nickel-based battery technology, energy storage downstream, and materials and components companies.

Prabhu also noted a direct correlation between specific categories of the sector receiving incentives and subsequently attracting funding. Categories like recycling, incentivized by the IRA, saw increased interest and funding.

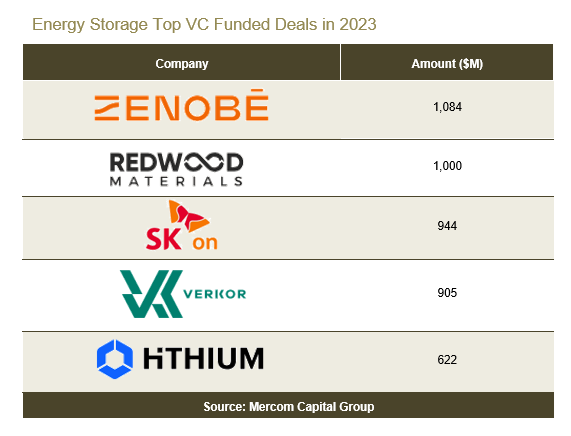

The top VC deals in 2023 were $1.1 billion raised by Zenobe, $1 billion raised by Redwood Materials, $944 million raised by SK On, $905 million raised by Verkor, and $622 million raised by Hithium.

In 2023, announced debt and public market financing for energy storage companies experienced a 52% YoY decline. A total of $9.8 billion was raised in 34 deals, contrasting with the $20.6 billion raised in 28 deals in 2022, which included LG Energy Solution’s $10.7 billion IPO.

Four energy storage companies went public in 2023, compared to six in 2022.

In 2023, 15 energy storage companies were acquired, compared to 28 in 2022.

A total of 28 energy storage projects, totaling 8.7 GW, were acquired in 2023. Only four of these transactions disclosed the amounts involved. This marks a 38% YoY decrease in project M&A activity, as compared to 2022, when 45 transactions involving 14.5 GW were recorded, with seven disclosing the transaction amounts.

Prabhu stated that M&A activity in the energy storage sector declined due to higher valuations, increased borrowing costs, and investor caution.

Smart Grid

Corporate funding for smart grid companies was down 30% YoY, with $3.3 billion in 60 deals compared to $4.7 billion in 58 deals in 2022.

VC funding in the smart grid sector fell 55% YoY, with $1.5 billion in 47 deals in 2023 compared to $3.3 billion in 46 deals in 2022.

“Funding in the smart grid sector decreased, driven by higher interest rates and challenges in various areas except for EV charging,” Prabhu said.

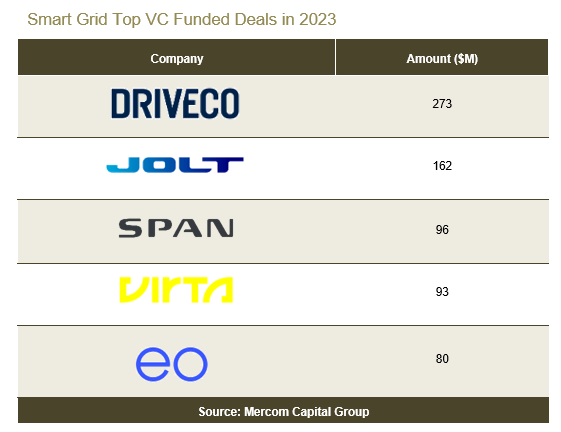

The top five smart grid VC funding deals in 2023 were: Driveco secured $273 million, Jolt Energy received $162 million, SPAN obtained $96 million, Virta garnered $93 million, and EO Charging closed a funding round with $80 million.

A total of 13 debt and public market financing deals, totaling $1.8 billion, were announced in 2023, compared to $1.4 million raised in 12 deals in 2022.

In 2023, the smart grid sector witnessed 11 M&A transactions, with disclosure available for four of them. This contrasts with the 20 transactions recorded in 2022, where information was disclosed for five of the transactions.

To get a copy of the report, visit: https://mercomcapital.com/product/annual-q4-2023-funding-ma-report-storage-grid