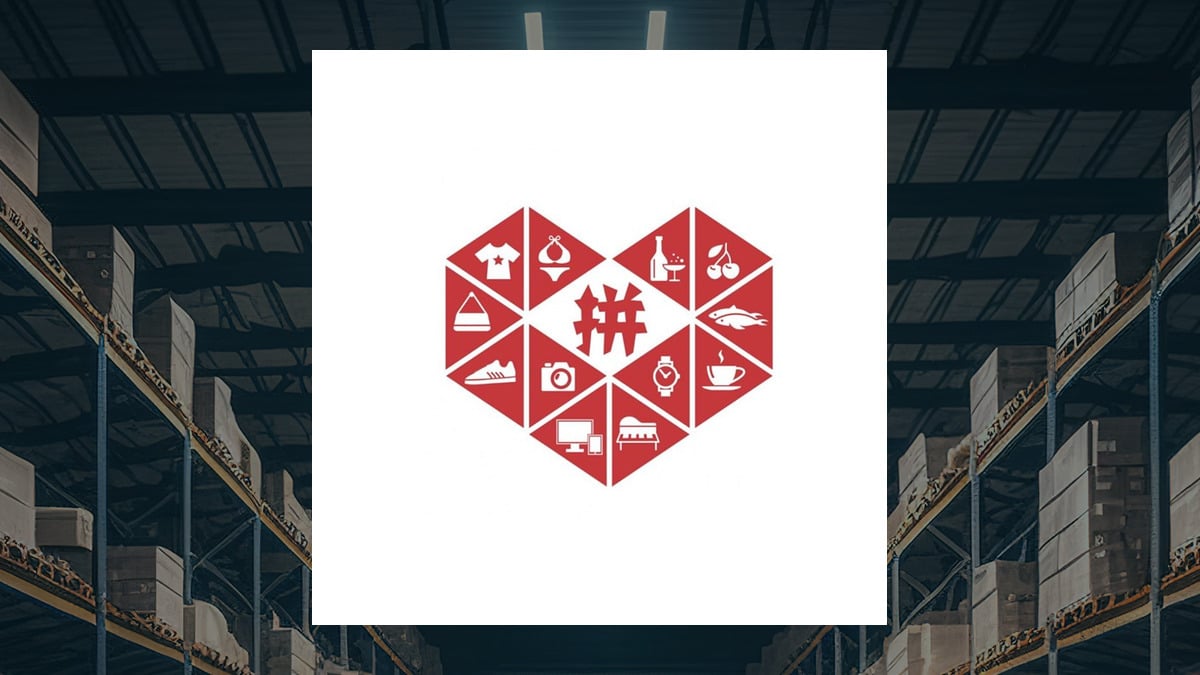

IDG China Venture Capital Fund IV Associates L.P. lessened its stake in PDD Holdings Inc. (NASDAQ:PDD – Free Report) by 5.8% during the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 7,705,545 shares of the company’s stock after selling 477,969 shares during the quarter. PDD accounts for about 98.7% of IDG China Venture Capital Fund IV Associates L.P.’s holdings, making the stock its biggest position. IDG China Venture Capital Fund IV Associates L.P. owned approximately 0.58% of PDD worth $755,683,000 as of its most recent filing with the SEC.

Several other large investors have also recently added to or reduced their stakes in PDD. Captrust Financial Advisors increased its stake in PDD by 108.5% in the 1st quarter. Captrust Financial Advisors now owns 636 shares of the company’s stock valued at $26,000 after buying an additional 331 shares during the period. Altshuler Shaham Ltd acquired a new position in shares of PDD during the 4th quarter worth $43,000. Psagot Value Holdings Ltd. Israel acquired a new position in shares of PDD during the 1st quarter worth $53,000. Wahed Invest LLC acquired a new position in shares of PDD during the 1st quarter worth $70,000. Finally, CWM LLC increased its stake in shares of PDD by 22.7% during the 3rd quarter. CWM LLC now owns 758 shares of the company’s stock worth $74,000 after purchasing an additional 140 shares during the last quarter. Institutional investors and hedge funds own 31.08% of the company’s stock.

PDD Trading Down 1.3 %

PDD stock traded down $1.86 during midday trading on Tuesday, hitting $144.45. 4,038,146 shares of the stock were exchanged, compared to its average volume of 6,649,138. The company has a fifty day simple moving average of $127.65 and a two-hundred day simple moving average of $101.76. PDD Holdings Inc. has a 52 week low of $59.67 and a 52 week high of $150.66. The stock has a market capitalization of $190.61 billion, a PE ratio of 32.88 and a beta of 0.78. The company has a quick ratio of 1.83, a current ratio of 1.83 and a debt-to-equity ratio of 0.01.

PDD (NASDAQ:PDD – Get Free Report) last announced its quarterly earnings results on Tuesday, November 28th. The company reported $11.61 earnings per share for the quarter, beating analysts’ consensus estimates of $8.94 by $2.67. PDD had a net margin of 23.25% and a return on equity of 34.07%. The firm had revenue of $68.84 billion for the quarter, compared to analyst estimates of $55.18 billion. During the same quarter in the previous year, the firm posted $1.03 earnings per share. The business’s revenue was up 93.9% on a year-over-year basis. Equities research analysts anticipate that PDD Holdings Inc. will post 5.06 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

Several research analysts have recently commented on the stock. UBS Group restated a “buy” rating and set a $137.00 price target (up previously from $115.00) on shares of PDD in a research note on Wednesday, November 1st. Benchmark upped their price objective on shares of PDD from $140.00 to $190.00 and gave the stock a “buy” rating in a report on Wednesday, November 29th. Finally, The Goldman Sachs Group upped their price objective on shares of PDD from $137.00 to $155.00 and gave the stock a “buy” rating in a report on Tuesday, November 7th. Ten equities research analysts have rated the stock with a buy rating, According to data from MarketBeat.com, the stock currently has an average rating of “Buy” and an average price target of $126.12.

Get Our Latest Research Report on PDD

About PDD

PDD Holdings Inc, a multinational commerce group, owns and operates a portfolio of businesses. It operates Pinduoduo, an e-commerce platform that offers products in various categories, including agricultural produce, apparel, shoes, bags, mother and childcare products, food and beverage, electronic appliances, furniture and household goods, cosmetics and other personal care, sports and fitness items and auto accessories; and Temu, an online marketplace.

Featured Stories

Want to see what other hedge funds are holding PDD? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for PDD Holdings Inc. (NASDAQ:PDD – Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider PDD, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and PDD wasn’t on the list.

While PDD currently has a “Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Click the link below and we’ll send you MarketBeat’s list of seven stocks and why their long-term outlooks are very promising.