Private equity backed nearly half of all deals targeting satellite companies in 2023 as national security concerns and improving industry economics further boosted the appeal of investments in the sector.

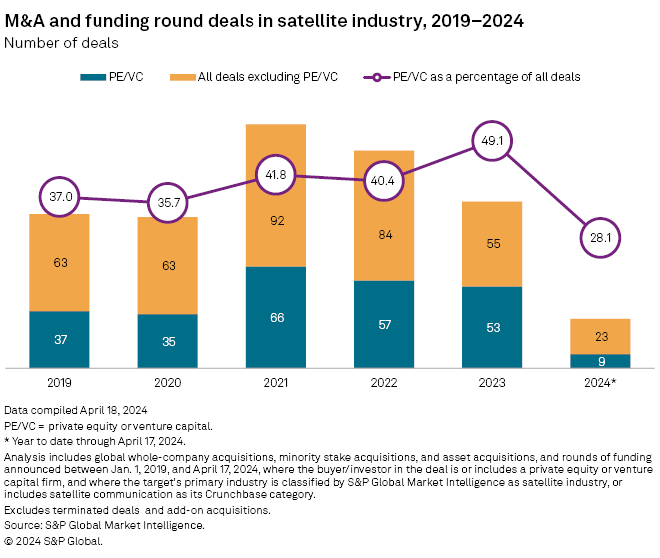

Private equity and venture capital firms were behind 53, or roughly 49%, of the 108 M&A deals and funding rounds targeting satellite-focused businesses in the past year, according to S&P Global Market Intelligence and Crunchbase data. That was private equity’s largest share of satellite industry investment volume since at least 2019.

Multiple industry trends, including the decreasing cost of space launches, the industrialization of satellite manufacturing, and the growing demand from commercial and government clients for satellite data, are attracting private capital, said Kirk Konert, a managing partner at AE Industrial Partners LP, a private equity firm specializing in aerospace, national security and industrial services investments.

“[Satellite companies] are selling data to commercial and government customers, and [investors] can get behind the model,” said Konert, who added that he sees investment opportunities in the sector every week.

Selling data

Constellations of small satellites launched into low earth orbit for communications or earth-observation purposes are “one of the largest sectors for space investment,” said Maureen Haverty, investment principal for private equity firm Seraphim Space.

Venture capital is critical for helping satellite companies clear an early, costly hurdle: launching those satellites into space.

Once they are in orbit, the companies are basically selling data, which is something technology-focused venture capital investors can easily wrap their heads around, Haverty said.

National security factors such as government demand for satellite data, spurred by Russia’s war in Ukraine, and a new space race between the US and China have been driving the demand for satellite data.

“If you look over the last year, a lot of the really large investments have been driven basically by defense trends in the US,” Haverty said.

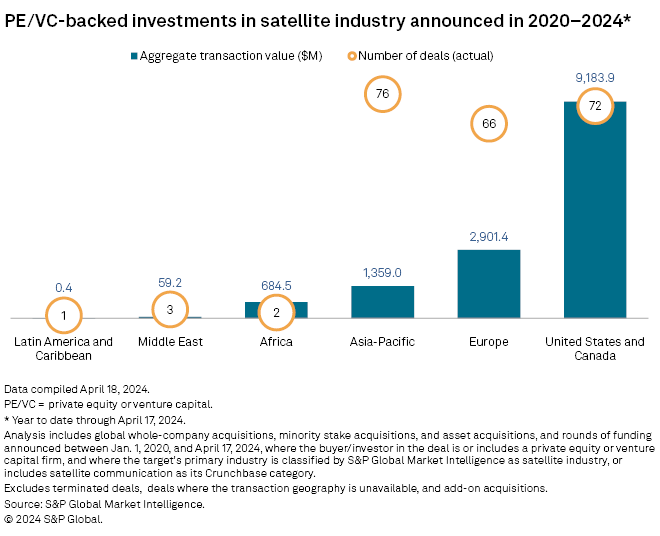

Since 2020, satellite industry companies based in the US and Canada have drawn more than three times the private capital brought in by those in Europe.

Drop in deal value

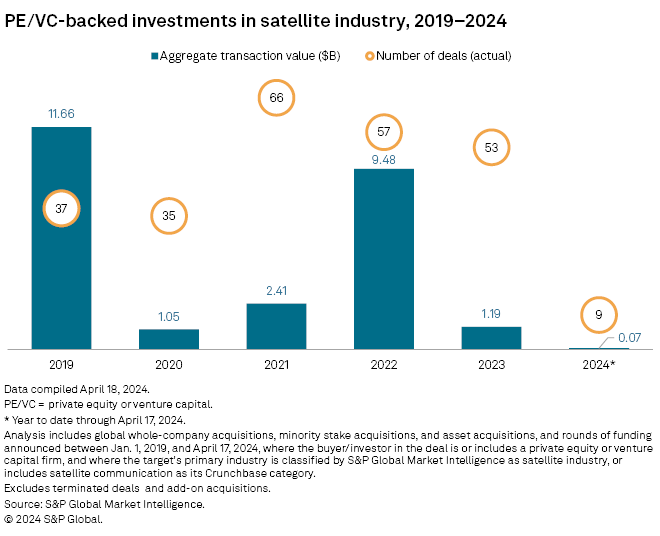

While private equity’s share of the satellite industry grew in 2023, the announced value of those deals plunged year over year. Private equity- and venture capital-backed investments totaled just $1.19 billion in 2023, down more than 87% from $9.48 billion in 2022.

In the broader space sector, global private investment increased for three consecutive quarters as of the first quarter, according to data from Seraphim, which invests in space technology. The increasing investment suggests a revival after two years of declines, which is linked to venture capital firms struggling during the interest-rate-hiking cycle when funding round value and volume tumbled, according to Haverty.

“[Space startups] raised huge rounds in 2021 at high valuations, and they could not or did not want to return to the market whilst VC interest [and] appetite was down in 2022. They were worried about taking down rounds,” Haverty said.

– Download a file of raw data from this story.

– Catch up on private equity headlines.

– Read the latest on private equity exit activity.

Consistent demand

AE Industrial Partners’ Konert said stable government demand for satellite data is an attraction not only for risk-tolerant venture capital investors but for private equity as well.

“It’s an investable sector because you have now a known demand for these products, for these services,” he said.

Seraphim’s Haverty said German space and technology group OHB SE and geospatial intelligence provider Maxar Technologies Inc. were examples of the targets drawing traditional private equity investors into the satellite industry. OHB was taken private by KKR & Co. Inc. in one of the largest private equity-backed satellite industry deals of the last 12 months, and Maxar was acquired by Advent and British Columbia Investment Management Corp. for $4.2 billion in December 2022.

“What do we think is consistent across those companies? All are revenue-generating and tend to have large government contracts,” Haverty said.