The founder of the Highworth Research database rebuts the idea that single-family offices have retreated from venture capital in the face of more challenging economic conditions.

(This news service carries the following commentary from

Alastair Graham, director, family office research, at Highworth

Research, a business that he founded. The firm has an

extensive database on the actions of single-family offices around

the world. This news service is its exclusive media partner. To

register for its database,

click here.)

On 5 January the Financial Times reported that

fundraising by US venture capital firms in 2023 had sunk to a

six-year low. The reasons are widely understood.

But the gloom can be overdone. One aspect of the problem facing

early-stage growth companies is that many are conditioned

primarily to solicit funding from venture capital companies and

do not look at the wider market for raising risk capital. Within

that wider market single-family offices form an important

source.

The problem, however, is that family offices are much harder to

identify. As a group they are opaque, only dimly visible, and

typically do not form a cohesive, easily accessible market such

as VC funds, pension funds, endowments, and other sources of

institutional or private capital.

Why single-family offices are a strong VC fundraising

source

Yet the journey to family office funding is worth making for many

young companies with promising growth prospects. There are good

reasons for this, including:

— There is wide availability of VC funding from single

family offices, which is not significantly retreating in the

face of economic headwinds;

— Family offices are not themselves dependent on external

funding, their capital is typically evergreen;

— Single family offices as a sector have continued to grow

rapidly in numbers over the past 15 years;

— Family office VC funding generally represents patient

capital, a willingness to invest for the longer term;

— Many single-family office principals like to invest in

business sectors which they themselves know well and often where

they have made their own fortunes. The quality of management

support for the startup may be strong in terms of recommended

business models, market entry processes, growth strategies,

useful contacts, and errors to avoid; and

— Venture capital investment is among the most popular asset

classes to which family offices allocate their capital.

The Highworth Database shows that 61 per cent of single-family

offices globally, or 1,546 out of 2,516 on the database, invest

in venture capital. That’s 2 per cent more than when Highworth

last analysed family offices for their VC allocation only eight

months ago.

Venture capital is the fourth most popular asset class to which

family offices allocate capital, after equities (74 per cent of

family offices), real estate (66 per cent), and private equity

(62 per cent).

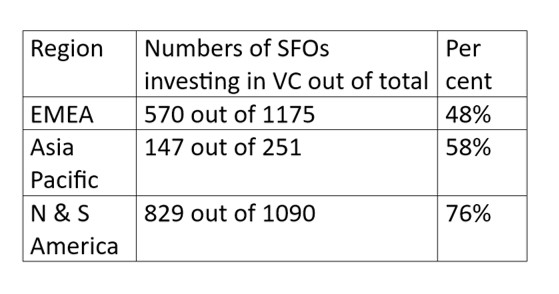

However, the opportunities for fundraising from single family

offices vary depending on the region. The table below shows that

the chances of an early-stage company raising capital from a

single-family office in North America are far higher than in

Europe:

Moreover, in the case of Europe, Middle East and Africa, and

Asia-Pacific, the percentage of family offices investing in VC

has actually grown 2 per cent over the past eight months, and in

North America by 1 per cent. In a period in which the economic

headwinds have been so strong, these numbers certainly don’t show

a retreat from VC funding but demonstrate the resilience of

single-family offices as a VC fundraising source.

A straightforward professional solution for fundraising from

family offices is to use the Highworth Single Family Office

Database. This well-established online database provides detailed

profiles, including contacts at over 2,500 single family offices

globally, and identifies which ones invest in venture capital

either directly or through third-party funds or both. What’s

more, the database shows the business sectors in which each

family office in each of over 70 countries prefers to make its VC

investments.