The Main Item

A few recent funding rounds for high-profile unicorns shows pretty clearly the new state of play in growth investing: top VCs circling up to support just a few companies at premium valuations, while wrestling with the implications of a depressed IPO market that’s forcing even the best startups to stay private longer than many investors—not to mention employees—would like.

HR tech startup Rippling’s latest round of Series F funding fits the pattern: the $200 million round was led by Coatue and included other insiders such as Founders Fund, and comes with both a bump in valuation to $13.5 billion, and a $590 million tender offer for employees. It’s a step-up from its previous $11.25 billion post-Series E raise, where its valuation remained unchanged from its Series D in 2022. Dragoneer was the only new investor in the deal.

Fintech Ramp’s fresh $150 million, announced this week, was also insider-driven, with a valuation increase of 36% to $7.65 billion. The deal was co-led by Khosla Ventures and Founders Fund, and the rest of the cap table for this round reads as a “who’s who” of Sand Hill Road: Sequoia Capital, Greylock, Thrive Capital, General Catalyst, and Lux, among other firms.

Other recent growth rounds at high prices include Perplexity, which just closed $63 million in Series B funding, and is reportedly in talks to raise another round valued at $250 million right off the bat.

The good news is, valuations seem to be holding at the top of the market, even accounting for the insider incentive to mark things up. On the flip side, numerous unicorns have not raised fresh funding since the downturn began in 2022. According to fresh data provided by Crunchbase, while many unicorn valuations are holding strong, lots haven’t raised funds since the boom times of 2021, and could be in for a rude awakening when returning to market.

Some notable names from the data that haven’t announced new institutional funding rounds since then: Chime, Notion, Cockroach Labs, Plaid, and Hinge Health.

It’s a pretty archetypal haves-and-have-nots situation, and it’s not likely to change until the public markets become more cooperative.

But when and how that might happen is a question spooking tech investors. Usually, when tech stocks go up the public markets are welcoming to new issuers, and certainly the sector has enjoyed an epic bull run over the past year. Even before the market’s recent pullback, though, that wasn’t translating into very many IPOs.

One Big Chart

Dan Primack over at Axios suggests that this is a far bigger problem than anyone will admit. LPs are not willing to wait forever for distributions, and if they can’t cash in more than a decade later even on a clear home run like Stripe, they are likely to re-think their participation in venture investing altogether, Primack argues.

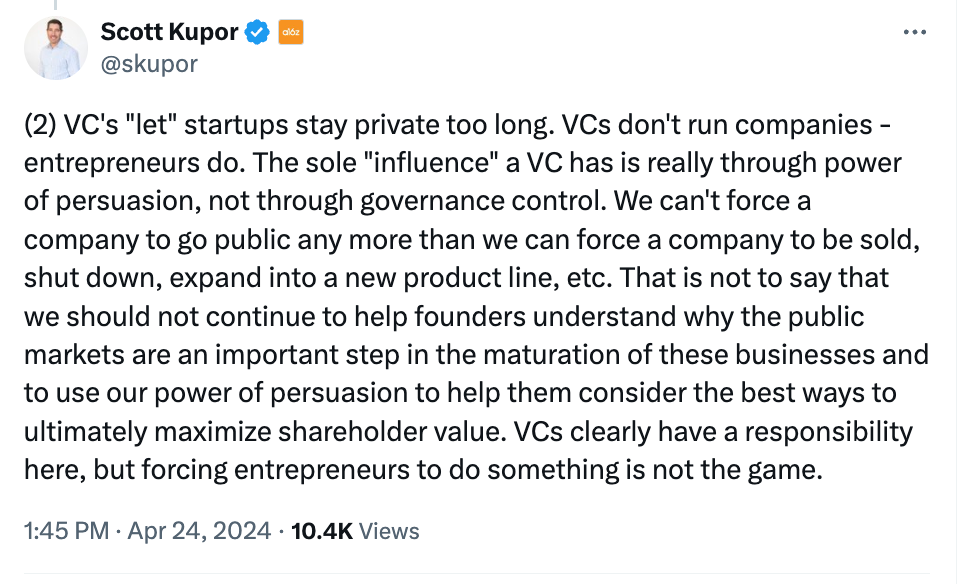

A16z’s Scott Kupor pushed back on this frame in a thread on X, saying that it ultimately is up to the founders, not investors, to decide when a company IPOs.

Michael Eisenberg of Aleph Capital had a slightly different take: “Unfortunately after 2021, many of the growth investors do not want to take the medicine of the public mark below where their last round was priced, ” he wrote on X.

Regardless of whether companies are staying private by choice or by necessity, though, it’s still an issue for LPs. Secondaries have kept employees happy, but big paper valuations only go so far for your average pension fund. And with M&A prospects diminished for many startups due to antitrust scrutiny of the Big Tech companies that might be buyers, the IPO issue looms large.

Yesterday’s Rubrik offering was a welcome ray of sunlight. The cloud and data startup priced its shares at opening at $32 yesterday, above its purported range of $28 to $31, marking its valuation at just over $5.6 billion. A few others, like Astera Labs, have managed to get out the door this year and retain or increase their value.

But the public markets are unpredictable at the best of times, and this year has the added uncertainty of a volatile presidential election. If tech stocks stay strong, at least some IPOs will happen and it will be easy for everyone to kick the can down the road on the bigger question. If they don’t, though, a reckoning may soon be at hand for successful private decacorns and their backers.