West Hartford-based Fairview Capital Partners Inc., one of the largest minority-owned private equity investment management firms in the United States, has promoted two executives to managing partners.

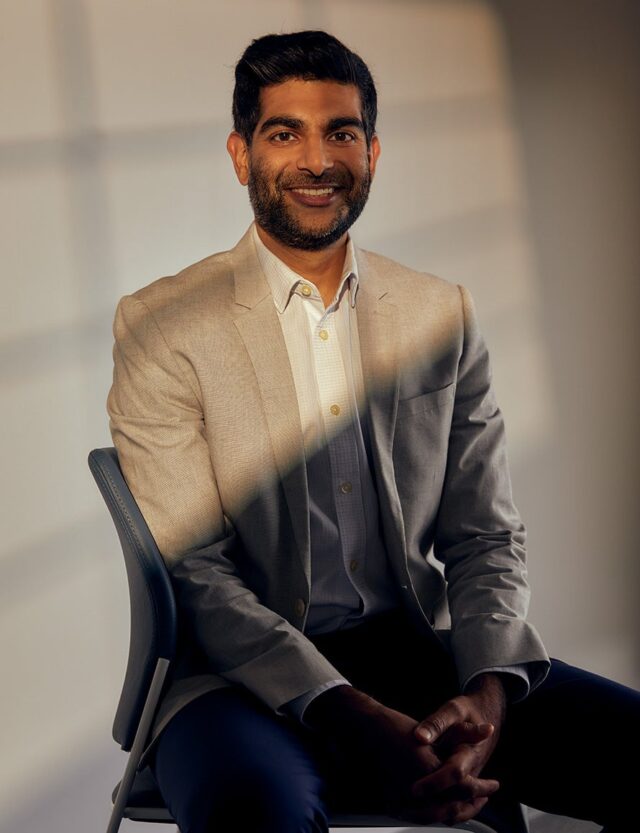

The promotions of partners Alan Mattamana and Aakar Vachhani to managing partner took effect Jan. 1. Each has been with the firm for more than a decade.

“Both have been integral to the firm’s growth and evolution, contributing through their invaluable leadership, deep expertise, and commitment to the firm’s culture of innovation and performance,” the firm stated in a news release. Company officials did not immediately respond to a request for additional comment.

Fairview Capital said that, in their expanded roles, Mattamana and Vachhani will continue to serve on the firm’s investment committee, and will play “a vital part in investment selection, deal execution, and monitoring activities for Fairview’s venture capital and private equity partnership and direct co-investment portfolios.”

The promotions mean Fairview Capital now has five managing partners, including co-founders JoAnn H. Price and Laurence C. Morse, and Dr. Kola Olofinboba. Olofinboba, a board-certfied internist/hospitalist and assistant professor at the University of Connecticut Health Center in Farmington, joined Fairview in 2007 and was promoted to managing partner in 2015.

Vachhani joined Fairview as an analyst in 2008. He established and leads the firm’s San Francisco office. Before joining Fairview, Vachhani worked with Cambridge Associates, where he analyzed private equity and venture capital investments. He also led research and data analytics projects on the firm’s private equity and venture capital database.

He holds a bachelor’s degree in economics-finance from Bentley University and an MBA in finance and entrepreneurship & innovation from the Kellogg School of Management.

Before joining Fairview in 2009, Mattamana served as a principal at Polaris Venture Partners, a diversified venture capital firm. Before that he was a strategy consultant at McKinsey & Co, where he served clients in the software, telecommunications, and aerospace sectors. He also has experience at NASA, Goldman Sachs, and Neuberger Berman.

He holds a chemical engineering degree from Princeton University and an MBA from Harvard Business School.

Founded in 1994 by Price and Morse, Fairview Capital is a venture capital and private equity investment management firm with over $10 billion under management since its inception, according to the firm.

Fairview Capital also was one of two Black-owned investment companies in 2022 to benefit from a $400 million commitment by former Microsoft CEO Steve Balmer and his wife. The Balmers committed to the investment to boost capital available to Black investment managers and Black-owned businesses with the goal of increasing capital to underserved markets.

The firm landed a $50 million investment, which it intended to match from other portfolios it manages. Between 80% and 100% was to be invested in early-stage venture capital funds, and up to 20% in later-stage growth equity funds, the firm said.