Stocks continue to mostly mark time ahead of key inflation data coming out tomorrow. Meanwhile, gold and silver are rallying again, with the former hitting another record high of $2,375 an ounce before easing back. Crude oil, Treasuries, and the dollar are mostly flat.

That inflation data we’re all waiting for is the March Consumer Price Index (CPI). Economists estimate prices rose 0.3% last month on both the headline and the core. That would leave the year-over-year inflation rate at 3.4% and the core at 3.7%. Any significant deviation one way or the other could cause rate futures markets to reprice notably. Traders are currently expecting one or two Federal Reserve rate cuts in the next few months.

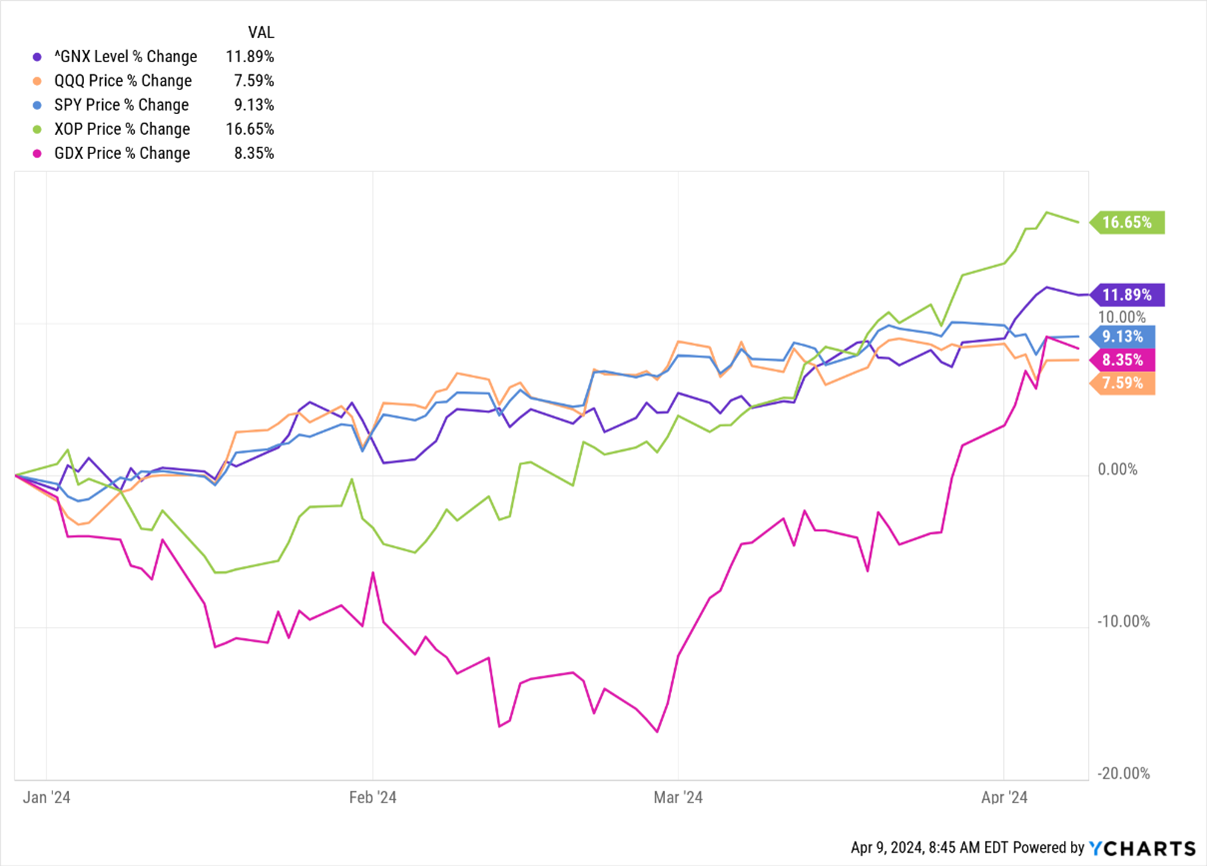

What a year it’s turning out to be for…COMMODITIES! While most of Wall Street and many investors were focused solely on “Big Tech” and the Magnificent Seven, prices for everything from oil to gold have been soaring – taking shares of commodity producers along for the ride.

Data by YCharts

The S&P GSCI index that tracks commodity prices is up around 12% this year, beating the 9.1% rise in the SPDR S&P 500 ETF Trust (SPY) and the 7.5% gain in the Invesco QQQ Trust (QQQ). Meanwhile, the SPDR S&P Oil & Gas Exploration and Production ETF (XOP) has climbed 16.6% and the formerly lagging VanEck Gold Miners ETF (GDX) is now showing an 8.3% gain after a big rally in the last month.

Finally, alternative, non-bank lenders and asset managers keep elbowing their way into things like commercial real estate financing that used to be the purview of big banks. Blue Owl Capital Inc. (OWL), for one, just agreed to buy Prima Capital Advisors to expand its commercial mortgage-backed securities business. It recently bought a life insurance asset manager for $750 million.