(Bloomberg) — Chinese commodities exchanges are ending the rebates paid on some automated trades, as the authorities seek to reduce volatility in markets that help set the prices that the country pays for raw materials.

Most Read from Bloomberg

The Shanghai Futures Exchange, the Dalian Commodity Exchange and the Zhengzhou Commodity Exchange will no longer give refunds this year to brokers on some of the program trades executed by their customers, according to notices from the bourses viewed by Bloomberg. Previously, they offered rebates that rose as trading volumes increased, and brokers passed on a portion of that to their clients.

The documents didn’t say specifically which trades have been targeted, but market participants said they expect an impact on high-frequency trading, which is conducted mainly by foreign investors. The rulings will affect so-called quant strategies generated by computer algorithms that involve the rapid buying and selling of securities, as well as dealing a blow to brokerage revenues that rely on maximizing activity.

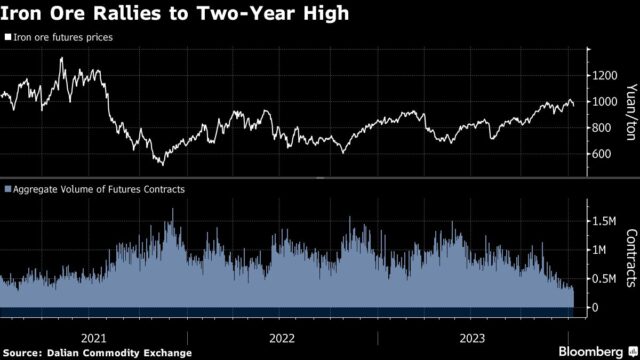

The exchanges trade derivatives across the commodities complex, from metals to energy, chemicals and agricultural products. Probably the most significant to international investors are the Shanghai copper and Dalian iron ore contracts. The latter has often drawn scrutiny from the authorities for price gains they’ve attributed to speculation and characterized as excessive. Dalian also trades important farm goods like soybeans and corn on which China is also heavily import dependent.

The Shanghai exchange declined to comment. The Dalian exchange couldn’t be reached for comment. Zhengzhou didn’t respond to a request seeking comment. The Securities Times reported on Dalian’s move earlier this week.

Bad News

“It would be very bad news for the futures companies,” said Michelle Leung, an analyst with Bloomberg Intelligence. High-frequency traders “mainly rely on the rebate to increase their profits. High-frequency strategies are extremely sensitive to trading fees.”

The China Securities Regulatory Commission, which oversees the exchanges, said last week it will strengthen supervision of program trading on commodity futures by adjusting transaction fee refunds. The move follows a tightening of regulations in September on automated stock trading to reduce volatility in that market. The CSRC didn’t respond to a request for comment.

Program trading is a handy tool for speculators that reduces staffing costs and allows firms to more quickly pounce on market opportunities. It’s also been blamed for exacerbating price moves, particularly when too many computer-generated orders are working to the same strategy. But reducing automation also carries risk, because more buyers and sellers, whether human or artificial, typically enhances market liquidity and suppresses volatility.

On top of the program trading rebates, Dalian and Zhengzhou have also canceled refunds on the usual transaction fees for some products including iron ore, coal, coke and glass, according to the notices.

Chinese authorities have regularly intervened to cool iron ore prices, including summoning brokers to warn them about facilitating excessive speculation. Elevated prices of the key feedstock for the steel industry are a sensitive matter because of their potential impact on the cost of infrastructure and manufacturing.

Fee rebates, first introduced to boost turnover, have generally been in decline over the years as the government has deemed that financial aid is no longer warranted given the successful development of the local futures industry. But this round of cuts lands at an inopportune time for the country’s financial sector, which is feeling the strain of China’s economic slowdown on already tight budgets and has forced firms to reduce pay.

The Week’s Diary

(All times Beijing unless noted otherwise.)

Thursday, Jan. 11:

Friday, Jan. 12:

-

China’s inflation data for December, 09:30

-

China’s 1st batch of December trade data, including steel, aluminum & rare earth exports; steel, iron ore & copper imports; soybean, edible oil, rubber and meat & offal imports; oil, gas & coal imports; oil products imports & exports. From 10:00

-

China’s monthly CASDE crop supply-demand report

-

China weekly iron ore port stockpiles

-

Shanghai exchange weekly commodities inventory, ~15:30

On the Wire

China’s efforts to lower risks from local government debt are likely to weigh on growth again this year as a national deleveraging campaign is expected to curb spending on investment projects.

Global fund giant Loomis Sayles & Co. is turning more positive on China’s battered real estate sector, saying recent restructuring is bearing fruit and improved sentiment may result in a faster-than-expected bounceback.

China’s booming electric vehicle industry is turning into a strong growth driver, but it won’t be enough to fill the hole left by an imploding property sector, according to Bloomberg Economics.

–With assistance from Zhang Dingmin.

(Updates with SHFE ending refunds on some program trades from the second paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.