(Bloomberg) — International investors have become skittish over Indonesian bonds as election pledges have spurred burgeoning budgetary fears and a possible spending spree.

Most Read from Bloomberg

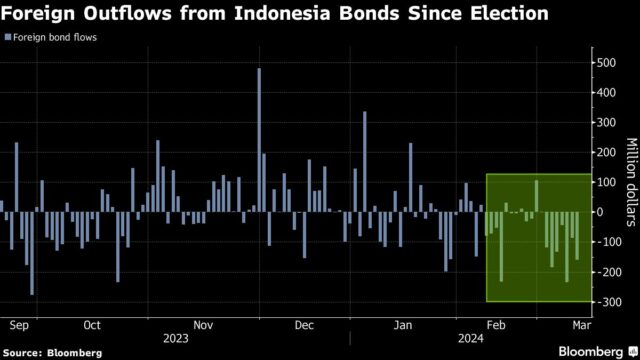

Global funds have withdrawn $1.1 billion from Indonesian bonds since balloting closed on Feb. 14, with net foreign bond outflows in 16 out of the 20 days since. Regional peers South Korea and India have seen offshore inflows while Thailand observed an outflow of only $502 million over the same period.

Incoming President Prabowo Subianto’s election promises — such as the plan to give out free school lunches and milk to more than 80 million children — have spooked investors, even as he has vowed to maintain fiscal discipline. Prabowo’s spending spree could amount to 460 trillion rupiah ($29 billion), more than the entire 2023 budget deficit.

Emerging market-focused real money and hedge funds have “expressed concerns over potential fiscal loosening by the new incoming government, as they pledged a free lunch program during their campaign without details on how it would be financed,” Goldman Sachs strategist including Danny Suwanapruti wrote in a note last week.

While there are long-term health benefits from the free school lunch program, “it is important that any fiscal expansion is done in a sustainable way – so we should watch the spending pledges carefully,” said Jon Harrison, managing director for emerging-market macro strategy at GlobalData TS Lombard in London.

Fiscal consolidation concerns may result in higher rupiah yields, which would increase the cost of funding for Indonesia’s government. Bank Indonesia left its benchmark interest rate unchanged this week, as did the Federal Reserve, with traders still looking for clues on future moves by central banks.

Under current Indonesian Finance Minister Sri Mulyani Indrawati, post-pandemic budget deficits have consistently outperformed initial targets. To fund the new polices, Sri Mulyani said that the fiscal gap may widen to 2.45%-2.80% of gross domestic product in 2025. That compares with this year’s target of 2.29%

Investors will also be keenly watching the cabinet line-up announcement on speculation that Sri Mulyani will be replaced. “She is credible and respected by markets, so there is a high bar for any replacement,” Harrison added.

–With assistance from Grace Sihombing and Claire Jiao.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.