(Bloomberg) — Five years after shutting down Macquarie Asian Alpha Fund, a pioneer of quantitative hedge funds in the region with $2 billion at its peak, veteran fund manager Nick Bird is back.

Most Read from Bloomberg

This time, he says, his fund will be smarter — and a lot smaller, on purpose.

Bird now leads OQ Funds Management, which he started in Hong Kong with $15 million of his own money in June 2020. While that’s grown to around $500 million of assets under management, he’s determined to avoid the kind of over-expansion that led to the disappointing returns and the eventual closure of his fund at Macquarie.

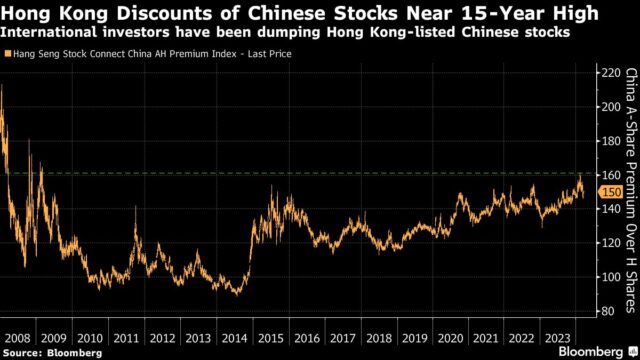

His new fund, which has handily outperformed the Eurekahedge Asia stock hedge fund index with a 12% annualized return from inception to February, will cap assets at around $750 million. One of the investment plays he’s eyeing now is the pricing gap between Chinese stocks listed on the domestic and Hong Kong exchanges, recently at its widest in 15 years. He also sees “unjustifiably cheap” valuations of Chinese technology stocks.

“This was a chance to learn from past mistakes and do things right,” said the soft-spoken 57 year old. The fund hasn’t been directly affected by China’s regulatory clampdown on Chinese quants. Starting on his own still hasn’t been easy, though, with multi-strategy, multi-manager giants absorbing most of the fresh inflows into the global hedge fund industry and appetite cooling for Asia funds. “It’s much harder than it used to be in the old days.”

An Australian native and son of a former head of University of Sydney’s department of aeronautical engineering, Bird bought his first stocks when he was 10 years old. The formative years of his career at Macquarie in the mid-1990s were spent researching Asian quant factors. The Macquarie Asian Alpha Fund, which he started in 2005, was one of the few multibillion-dollar, Asia-dedicated hedge funds that used computer models to help pick stocks.

One of Bird’s widely regarded strengths has been his use of so-called discretionary overlay, in which he employs computer models to screen stocks, but he also uses his own judgment to select or assign weightings to individual stocks and factors.

The Macquarie team eventually moved away from such discretionary overlay as its assets grew, relying more entirely on quant models as its investments expanded to Europe and Americas, in addition to the Asia-focused fund. Bird was responsible for all three, which at their peak had $2.8 billion of assets combined. The funds’ large asset size and investments spanning three vastly different time zones meant he could no longer effectively exercise his judgment or trade in and out of positions frequently with stealth.

After making money in all but one year in its first decade, the Asian fund suffered four consecutive years of losses before Macquarie pulled the plug in November 2018. Bird left Macquarie in 2019.

“It was a mistake to diversify outside of Asia,” Bird said. “An even bigger mistake was taking in too much money into both the Asian fund and the European fund.”

Keen not to repeat such mistakes, Bird is determined to cap the firm’s asset size and to maintain its focus in the region where the number of stocks with analyst coverage and large turnover is higher than in Europe. He also wants to return to his roots of combining computer models and human decisions.

Bird’s old fund gathered $800 million within 27 months. This time around, it took almost the same amount of time for OQ to gain its first external investor, Ari Glass’s New York-based Boothbay Fund Management, and 30 months for firm assets to hit the $50 million mark.

Bird’s new fund maintains about 1,200 stock positions. His return to the discretionary overlay has been successful so far. In 2020, its first year, the fund fell 2% as Covid-19 dominated markets, but large quant funds relying on computer modeling of historical data fared even worse, some of them ending 2020 with double-digit losses. OQ notched high single-digit to mid-teen returns in the following three years. While a Eurekahedge Asia stock hedge fund index tumbled nearly 11.7% in 2022, the steepest since 2008, OQ’s Asia Absolute Alpha Fund was up nearly 15%.

International investors spooked by geopolitical tensions and deflation have been dumping Hong Kong-listed shares, leading to a widening gap with the domestic yuan shares of dual-listed companies. Bird noted that large, liquid Chinese stocks such as China Life Insurance Co., are as much as 70% cheaper in Hong Kong than in China, an abnormality given they offer the same voting rights and dividends. He is taking long positions in some of those Hong Kong shares, combining them with short positions in either the yuan shares or the FTSE China A50 stock index futures.

“We also believe that Chinese tech shares are unjustifiably cheap,” he said, adding that he has long positions in Alibaba Group Holding Ltd., Baidu Inc, Tencent Holdings Ltd. and JD.com Inc., which have been using excess cash to step up share repurchases.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.