Tonight in Unpacks: A month after securing a 30-year lease for Camden Yards, the Angelos family decides to sell the Orioles for $1.7 billion, as more pro teams look to the private equity world for buyers.

Also tonight:

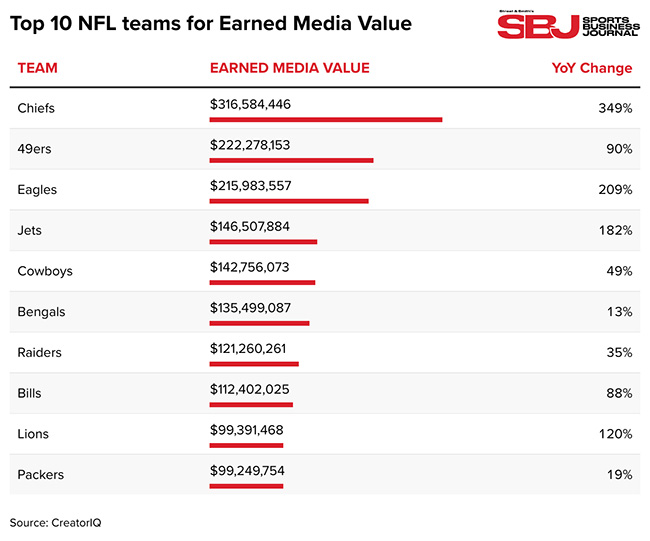

- Super Bowl LVII, Taylor Swift generate $316.6 million in earned media value for Chiefs

- WNBA’s Golden State franchise tabs Jess Smith as president

- EA Sports FC 24 — even without FIFA branding — helps company’s Q3 results

- State of facilities projects in 2024

Listen to SBJ’s most popular podcast, Morning Buzzcast, where Abe Madkour discusses the NFL’s massive postseason, the PGA Tour closing in on a multibillion-dollar deal with Strategic Sports Group, rumblings of a “premium” tennis tour, Arthur Blank’s SBJ Lifetime Achievement award and more.

Our friend John Ourand promised to open eyes when he filed his first offering for his new employer, Puck, and he delivered pretty well with breaking news about his favorite team.

Orioles owner John Angelos “has agreed to sell the franchise to a group led by two private equity billionaires” — David Rubenstein, who started the Carlyle Group, and Ares Management co-founder Mike Arougheti.

The deal values the Orioles at $1.7 billion, and “as part of the deal, the group will start off owning about 40 percent of the club” and will purchase the “remaining stake following the death of Peter Angelos.” MLB owners are set to meet in Orlando next week and “will receive details of the sale,” for which there “isn’t a timetable for the deal to close.” Rubenstein, a Baltimore native who “has been tied to the deal for months,” will “become the ‘control person’” of the Orioles under the deal.

While the reported value isn’t fetching the $2.4 billion that Steve Cohen paid for the Mets in 2020, it’s in line with other recent sales and may also represent a minority interest discount, as SBJ’s Chris Smith notes.

A group headed by Bruce Sherman and Derek Jeter bought the Marlins in 2018 for $1.2 billion, and John Sherman paid $1.1 billion for the Royals in 2020. Both the Marlins (2003, 1997) and the Royals (2015) have won World Series titles more recently than the Orioles (1983). And two of them — Cohen (a hedge fund manager) and Bruce Sherman (a wealth-management firm co-founder) — made their fortunes in finance. Should the deal be completed, the Orioles sale will remove two potential bidders for the Nationals, which have also been looking for a buyer, Smith notes.

In late December, there was some uncertainty about the Orioles’ fate. The Wall Street Journal noted that while the elder Angelos “made it clear what he wants to happen with his team upon his death: His family should sell,” John Angelos (the Orioles chair) “appears to have other plans.”

One key issue remains unclear: Maryland in December approved a 30-year lease agreement with the Orioles for Camden Yards and $600 million for improvements, and the Orioles have a “wish list” for improvements to the facility, notes the Baltimore Sun.

Sales talks could also be why the Orioles have had a quiet offseason, with just one notable free-agent signing — 36-year-old closer Craig Kimbrell for a one-year, $13 million contract in early December.

After winning the Super Bowl in February and Taylor Swift’s heart last fall (via her relationship with TE Travis Kelce), the Chiefs rose to the top of CreatorIQ’s 2023 NFL earned media leaderboard, generating an estimated $316.6 million in digital earned media value (EMV), reports SBJ’s David Broughton.

The number of sponsored and non-sponsored social media posts mentioning the Chiefs grew 349% over calendar year 2022. The team’s top EMV-driver was ESPN (@espn on Instagram), with $33.6 million EMV via 577 posts. People Magazine (@people), Entertainment Tonight (@entertainmenttonight), and E News (@enews) powered a collective $20.4 million EMV.

Taylor Swift has appeared at 12 Chiefs games since Sept. 24 and was responsible for extensive social conversation, with #TravisKelce and #TaylorSwift prompting a respective $30 million and $27.2 million in value. However, most of the team’s momentum stemmed from its Super Bowl victory in February, when the Chiefs netted $74.2 million that month. MLB, MLS, the NHL and the PGA of America are among CreatorIQ’s sports clients.

The Chiefs-Ravens game on Sunday afternoon delivered CBS the most-watched AFC Championship ever, drawing 55.5 million viewers, reports SBJ’s Austin Karp. The previous record was back in 2011 for Steelers-Jets (54.9 million), which was a prime-time window.

The Chiefs’ 17-10 win over the Ravens peaked at just over 64 million viewers toward the end of the game in the 6pm ET quarter hour. Sunday afternoon’s game is up 4% from 53.1 million viewers for Chiefs-Bengals in the AFC title game in prime-time last year, and up from 47.5 million for Eagles-49ers on Fox in the afternoon championship window last season. This is the first time the AFC Championship has drawn over 50 million viewers in consecutive years since 1982 and 1981 on NBC (and 1980 for that matter). Chiefs-Ravens is CBS’ best non-Super Bowl telecast of any kind since 1994, when the Friday night women’s figure skating action at the Olympics drew 73.5 million (fueled by Tonya Harding-Nancy Kerrigan drama).

Golden State’s WNBA expansion franchise hired Jess Smith as its team president and first employee, reports SBJ’s Tom Friend. Smith helped launch the NWSL’s Angel City FC in 2020 as the team’s head of revenue and, as of Feb. 14, will begin a similar process in the Bay Area.

The yet-to-be named WNBA team is slated to join the league in 2025. Warriors co-owners Joe Lacob and Peter Guber have already pledged to play their WNBA games in S.F.’s 18,000-seat Chase Center — not an easy place to fill. “Challenge accepted,’’ said Smith, a member of SBJ’s 2023 class of Forty Under 40.

Smith has previously been VP/sponsorship for the Earthquakes (2017-20) and had stints with the Blue Jackets (2015-16) and A’s (2008-15). She will report to Warriors President and COO Brandon Schneider. The Warriors handled the search in-house.

EA Sports’ rebrand of its flagship soccer franchise away from the FIFA moniker not only “didn’t miss a beat” when it came to sales, but it also showed its strength on EA’s Q3 earnings report, spurring the video game publishing giant to record bookings for live services, notes SBJ’s Jason Wilson.

EA Sports FC 24’s net bookings were 7% higher than what FIFA 23 delivered, while the publisher’s Madden NFL 24 net bookings grew 5% year-over-year. This helped EA set a new company record for net bookings for live services at $1.71 billion, up 3% from 2023, with live services now making up 73% of EA’s overall business with revenue at $1.3 billion. Full game revenue was at $618 million for the quarter.

But even with the strong live services numbers, EA’s stock closed the day at $134.55, down $1.03, and is down $3 to $131.55 in after-hours trading.

Range Sports and The CW struck a partnership that will see the agency help the Nexstar-owned network grow and monetize its sports programming portfolio through assistance with strategy, sales and programming services, reports SBJ’s Austin Karp. The CW airs ACC football and basketball and LIV Golf, and starting in 2025, it’ll carry the NASCAR Xfinity Series and WWE’s “NXT” show.

Range Sports, a division of Range Media Partners that launched in the summer of 2022, will develop and build new content and event franchises under the guidance of Range Sports co-Presidents Will Funk and Greg Luckman, who led talks on the deal alongside Nexstar CRO Michael Strober. With the CW being a newer player in the sports rights space, Funk hopes Range will be able to help the network “extend the rights that they’ve purchased and ultimately help them monetize those properties.”

Despite what’s now nearly two years of worsening macroeconomic headwinds, industry experts say that they’ve never seen so many facility projects happening at once. More than 280 stadium and arena projects (new and major renovations) are slated to wrap up by 2025 or later. Their total construction costs of $31.4 billion are the highest in the 25 years for which SBJ has tracked facility spending.

One substantial driver of new venue projects, reports SBJ’s Bret McCormick and Chris Smith: a generation of stadiums and arenas built in the 1990s and early 2000s that have reached the key point of their life cycle in which owners and operators consider whether to renovate or build a new venue. Either decision can cost hundreds of millions of dollars, billions in the case of new builds. The second major contributor is the proliferation of mixed-use districts surrounding sports venues with housing, retail and additional entertainment options.

With those two driving forces and the possibility of easing interest rates in the coming year, an already frothy market may soon hit peak frenzy. Coverage of the state of facilities includes:

IndyCar CEO Mark Miles concedes that the current media rights market is challenging, but he also likes his hand and thinks the series will have a good grasp on its future by April, reports SBJ’s Adam Stern. Miles touched on being in the market at a time when media companies are being careful about spending amid cord-cutting in cable and steepening losses in streaming. “It’s a tough market,” he noted. “NASCAR made a really good economic deal, but it took a whole lot longer than anyone expected, including [NASCAR President Steve Phelps,] because it was very challenging. But for the right properties, there’s still real money changing hands. So there’s headwinds, but the other side of it is we’re pleased with the interest in our rights.”

Also in this week’s SBJ Media newsletter, Austin Karp reports 49ers-Lions was the best NFC Championship game in 12 years.

- Athletes Unlimited Pro Basketball, entering its third winter as an alternative and innovative league for women, signed 15 WNBA stars, including Atlanta Dream F Haley Jones, L.A. Sparks F Rae Burrell and Minnesota Lynx F Emily Engstler, reports SBJ’s Tom Friend.

- Overtime is bringing back its boxing property for a second year, and it will have some new elements, including taking the show on the road after the first season was held only in Atlanta, writes SBJ’s Adam Stern.

- LIV Golf agreed to extensions through the end of the 2025 season with five members of its broadcast team, and it added two more roles, as the league begins play on Friday in Mexico, reports SBJ’s Josh Carpenter.

- Panini augmented its NBA trading-card rights with a title sponsorship of the Rising Stars Tournament on Feb. 16, which will showcase the league’s top sophomores and rookies and air on TNT, writes SBJ’s Terry Lefton.

- Major League Rugby is switching its ball provider from Rhino Rugby to Gilbert, giving the league access to Gilbert and Sportable’s jointly developed, sensor-embedded “Smart Ball” for nationally televised matches for at least the next two seasons, notes SBJ’s Rob Schaefer.