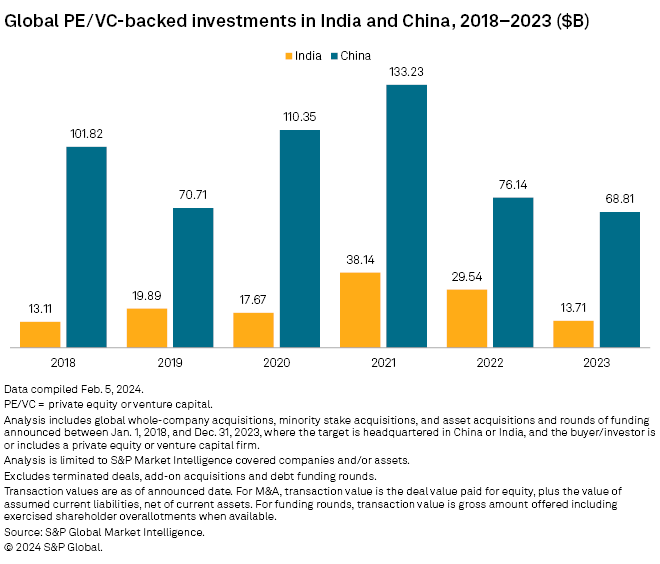

Two of Asia-Pacific’s largest economies saw a fall in private equity-backed investment value in 2023.

India recorded a 53.6% year-over-year drop in private equity-backed investments to $13.71 billion in 2023, outpacing the decline in deal value in China, according to S&P Global Market Intelligence data.

Transaction value in China, the region’s largest economy, stood at $68.81 billion in 2023, down 9.6% from the prior year.

The drop in private equity investments into China and India in 2023 mirrored the broader trend of private equity entries worldwide, dragged by the rapid and big interest rate hikes in 2022 and 2023 to fight inflation, Victoria Chernykh, assistant vice president for research insights at Preqin, told Market Intelligence in a written response.

The drop in investments was also attributed to the prolonged economic uncertainty in China, as well as the intensified geopolitical tensions in the region.

“As a result, investors have adopted a more cautious stance toward investment in China, and the Asia-Pacific, including India, overall,” Chernykh said.

– Download a spreadsheet with data in this story.

– Read about private equity investments in insurance in 2023.

– Explore more private equity coverage.

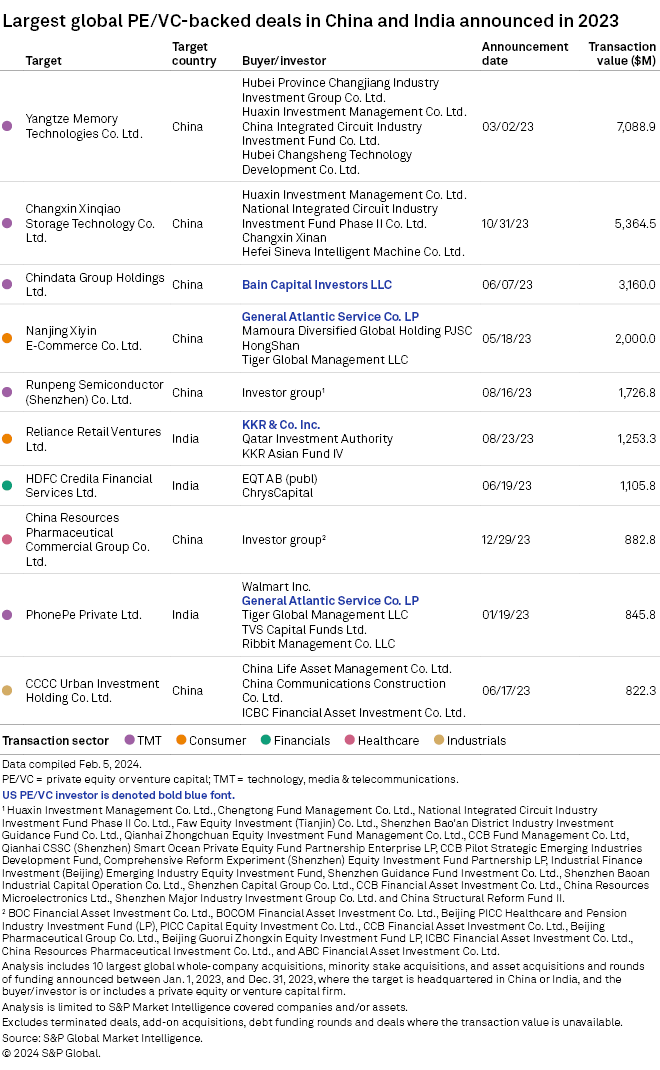

In 2023, India recorded $11.79 billion in private equity-backed investments from outside the country, accounting for almost 86% of the total, according to Market Intelligence data. In contrast, private equity investments in China were mainly from local sources, with only $15.61 billion, or around 22.7% of the total, were externally sourced.

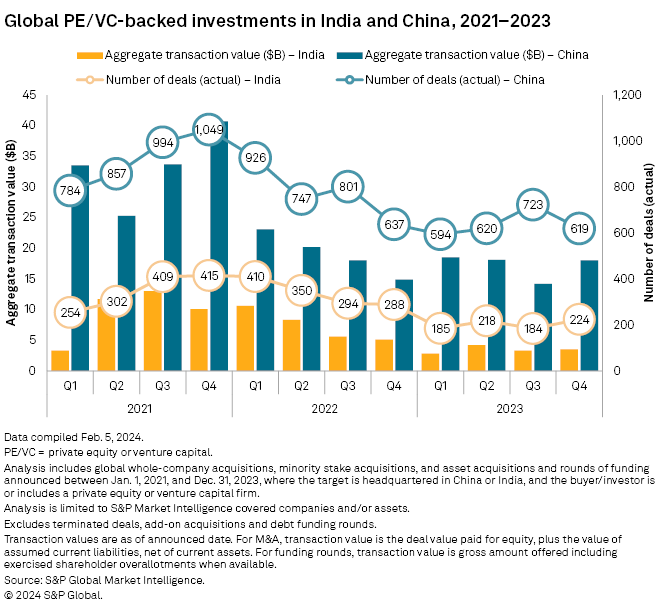

In the fourth quarter of 2023, private equity-backed entries in India dropped to $3.5 billion from $5.1 billion a year earlier. In China, entries grew to $18 billion in 2023 from $14.9 billion in 2022.

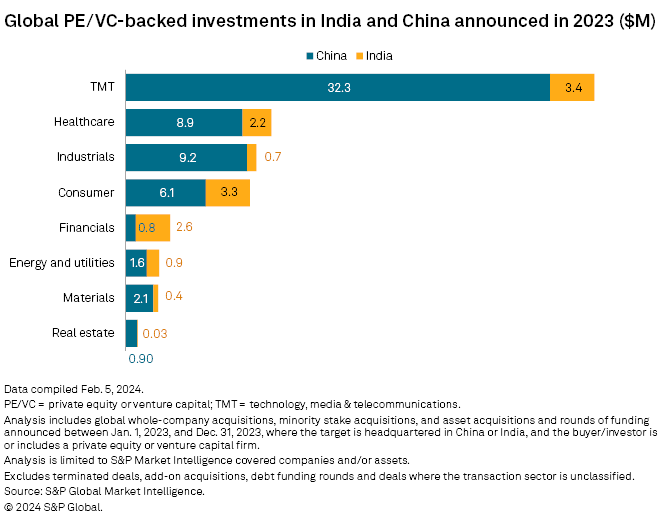

In 2023, the technology, media and telecommunications sector attracted the largest amount of capital in India and China, with about $3.4 billion and $32.3 billion in transaction value, respectively.

In the largest transaction in China in 2023, Yangtze Memory Technologies Co. Ltd. secured around $7.09 billion in a funding round, according to Market Intelligence data. Huaxin Investment Management Co. Ltd. and Hubei Province Changjiang Industry Investment Group Co. Ltd. participated in the round.

The largest transaction in India in 2023 was the $1.25 billion funding round of Reliance Retail Ventures Ltd. KKR & Co. Inc.’s KKR Asian Fund IV participated in the round.

Outlook

Preqin expects private equity fundraising in Asia-Pacific to record an annualized decline of 6.5% until 2028, with more weakness in 2024 before a gradual recovery later in the forecast period.

“We maintain our view that China remains the key to a full regional recovery, given that it is where investment is greatest, and it has the deepest capital markets in the region,” Preqin’s Chernykh said.

“Investors’ increasing interest in India and Southeast Asia should continue to attract funds into APAC-focused private equity. However, it will take some time and there could be downside risks if Chinese economy deteriorates further.”