The space startup ecosystem has been a topic of intrigue and speculation for investors and industry experts alike. While the overall venture capital (VC) investment in the space startup sector seemed to take a downturn in 2023, plunging by 32% compared to 2022, there is more to the story than what meets the eye.

The Investment Scenario

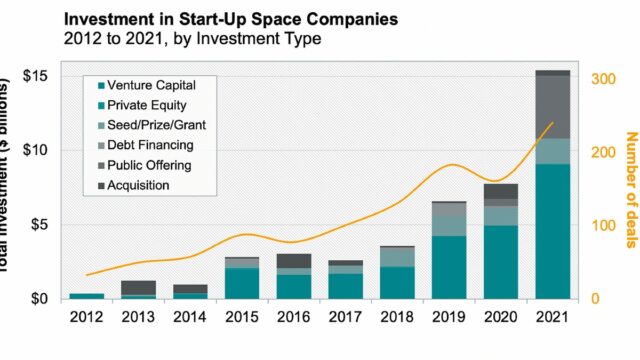

Despite the decline, the sector managed to attract over $11 billion in investment, split across 289 deals. Intriguingly, 24% of these deals were series A rounds, a percentage that far exceeds the typical average of 12% observed in other sectors. This suggests that investors still recognize the potential of new players entering the space industry.

Infrastructure investments took the lion’s share of the funding, accounting for a whopping 73% of the dollars invested. This trend reflects the growing appetite among investors to build a sustainable space industry by investing in tools, technologies, and infrastructure.

Resilience Amid Challenges

Even as launch failures posed challenges, companies like Relativity Space, Rocket Lab, and Blue Origin showed resilience. Relativity Space secured a multi-launch agreement, Rocket Lab resumed its launch schedule, and SpaceX continued test launches for Starship. Their tenacity and persistence have set an example for other startups in this space.

Another noteworthy milestone was the successful landing of a spacecraft near the Moon’s south pole by India’s space program. This accomplishment not only puts India on the global space map but also underscores the decreasing cost of space missions, making them more accessible for countries and companies alike.

The Future of Space Startups

The potential for asteroid mining has been demonstrated through the successful return of NASA’s Osiris Rex mission and the launch of a prototype refinery by space startup Astroforge. This breakthrough could open up new avenues for resource acquisition, drastically changing the dynamics of space exploration and potentially, the global economy.

Furthermore, the space internet services industry is gaining momentum. SpaceX’s Starlink network tripled its traffic in 2023, particularly from Brazil, and is preparing for a potential IPO. This sector is expected to witness heightened competition with the entry of companies like Amazon and EutelSat Oneweb.

Geographical Insights

While the global investment trends paint an interesting picture, the venture capital landscape in specific regions also provides valuable insights. In Saudi Arabia, for instance, the VC sector experienced unprecedented growth in 2023. Initiatives such as LEAP, the Saudi Unicorns program, and the National Technology Development Program played a pivotal role in this growth. Saudi Arabia, with its expanding talent pool and resilient economy, is identified as a prime location for launching entrepreneurial ventures targeting the MENA market.

On the other hand, the Pacific Northwest experienced a slowdown in funding, with total funding to startups falling nearly 60% year over year. Despite this, several startups in the biotech, health tech, and aerospace sectors managed to raise significant funding rounds.

Conclusion

The space startup sector, despite facing challenges, continues to evolve and demonstrate potential for growth. The resilience of companies, the growing interest in space infrastructure investment, and the advent of new industries such as asteroid mining and space internet services, all suggest a promising future for the space startup sector. As we move forward, it will be interesting to see how these trends shape the future of space exploration and its economy.