That scepticism is rooted in a bearish start-up market, scant asset sales to prove value and a lack of transparency around individual fund investments, they argued.

“[Other investors] in fact some go further and also apply a discount to the core Seek multiple for governance and questionable capital allocation decisions,” Mr McLeod and Mr Bolus wrote in a note to clients on February 21.

“Whilst the fund’s managers presumably have great confidence in the outlook and the prescribed valuation of the fund, it is very difficult for outsiders looking in, with no meaningful data, to share the same optimistic view with confidence.”

Seek declined to comment, while the growth fund and Mr Bassat did not respond to a request for comment made via Seek.

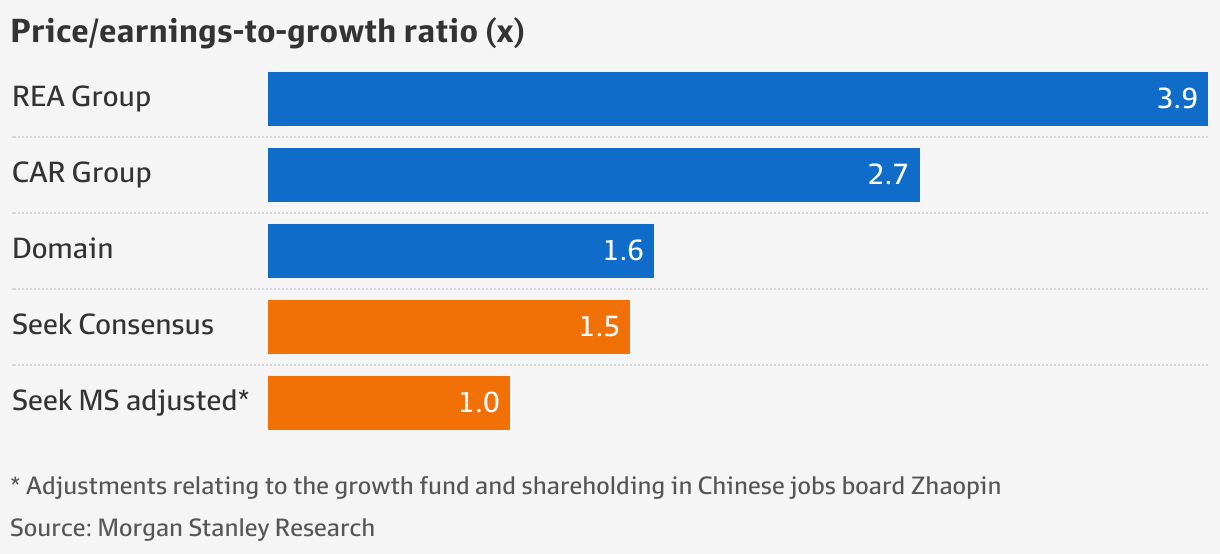

Other shareholders believed it was worth $5 a share to Seek, or even a premium, based on the $1.9 billion in cash Seek could realise from its VC interests. Seek had a market capitalisation of more than $9 billion at Friday’s close, trading at a lower multiple relative to other online classifieds companies.

Morgan Stanley laid out several options for Seek to improve how investors value the fund, which they argued should not be marked down from present levels. Seek could sell all or some of its 84 per cent stake, the fund could sell some assets to prove their value or Seek could redeem its share for cash under a contractual clause in 2026.

Mr McLeod and Mr Boulus, who are bullish on Seek, add that external factors – a return of technology company floats and more positive sentiment – could make a difference too. They contend that there should be no discount on the apparent value of the fund as reflected by Seek’s shares.

Seek’s ownership is valued at $1.9 billion and the circa $20 million in annualised management fees it pays out are recognised as an expense on its profit and loss statement. Seek had net debt of $1.1 billion as at December 31.