Venture capital investing dipped in Michigan in 2023, trailing a sharp national decline in deal volume and the amount of funds invested.

Last year, venture capital investors put $1.05 billion into 169 deals for Michigan-based companies, the second straight year for decline, according to a quarterly report by PitchBook and the National Venture Capital Association.

The 2023 results compared to $1.08 billion invested in 186 companies in 2022.

While both the annual deal volume and the amount of funds invested in the state were off from the peak in 2021, they remained well above any year prior to 2020. As well, Michigan largely avoided the steep nearly 30% decline in venture capital deals nationally. The amount of capital invested also dipped 10.3% across the country.

Keep up with all things West Michigan business. Sign up for our free newsletters today.

Paul D’Amato, the CEO and a managing director at Michigan Capital Network, wrote in an email to Crain’s Grand Rapids Business that last year followed a 2022 that was still one of the strongest years for venture capital nationally and the best year ever for the Grand Rapids-based investment firm.

“So, to have 2023 come very close to those peak levels is great to see and may be a sign of economic recovery,” D’Amato said. “Michigan does appear to be doing well versus the rest of the country.”

Michigan Capital Network manages four venture capital funds and five angel investor groups: Grand Angels in Grand Rapids, Ka-zoo Angels in Kalamazoo, Woodward Angels in Detroit, Flint Angels, and BlueWater Angels in Midland. The firm last year closed on a $37.5 million raise for its fourth venture capital fund, and in November began raising a targeted $10 million for the new Michigan Capital Network Opportunity Fund L.P. to make follow-on investments in existing portfolio companies.

The first half of 2023 was “quite slow” for Michigan Capital Network, D’Amato said. Activity picked up in the latter half of the year, and the fourth quarter was “quite busy,” he said.

Michigan Capital Network invested $10 million in 2023, versus $10.5 million in the prior year, over a similar number of deals, according to D’Amato.

Dale Grogan, a managing director at Michigan Capital Network, said 2023 was “arguably somewhere off the euphoria of 2021 and 2022, there are fewer new financings — mostly follow-on rounds of existing portfolio companies — which would dampen the overall deal count.”

Michigan “is a bit of a laggard as it relates to VC trends as compared to the coasts,” Grogan said. That’s because of “the velocity of deals, including pace and amount, is substantially more volatile on the coasts as compared to the Midwest.” As well, startup businesses that receive venture capital investments in the Midwest are generally life sciences, advanced manufacturing and technology companies that “tend to have financings that are attached to longer, more specific benchmarks with less volatility.”

“But ultimately, Michigan plods, not too flashy, but … just quietly getting the job done,” Grogan said.

In the fourth quarter alone, Michigan had 25 venture capital deals for $216.6 million, which compared to $231.4 million in 45 deals in the final three months of 2022.

The largest venture capital deal in the state in the fourth quarter involved May Mobility Inc., an Ann Arbor-based autonomous vehicle company that closed on a $105 million Series D round, according the PitchBook and the NVCA. Censys Inc., a cybersecurity and internet intelligence company also based in Ann Arbor, had the second-largest deal with a $75 million Series C funding round the closed in October.

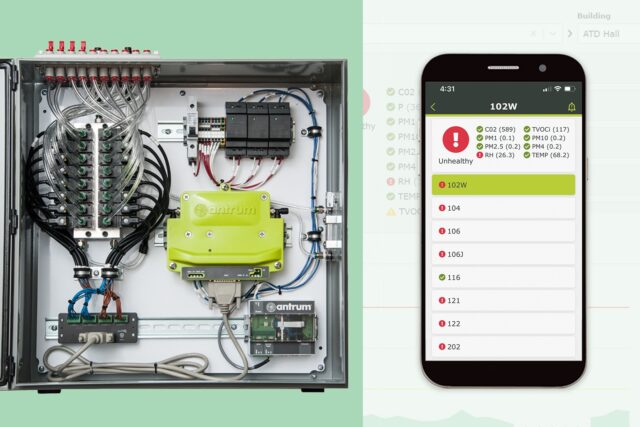

Among the top West Michigan deals in the quarter was $2.7 million for Antrum Inc., a Grand Rapids-based sensor technology company that specializes in indoor air quality monitoring for commercial HVAC systems. Antrum closed on the later-stage funding round in mid December.

Nationally, the NVCA and PitchBook counted 15,766 venture capital deals for all of 2023 for $170.6 billion, which compares to 17,592 deals for $242.2 billion in the prior year. In the fourth quarter alone, venture capital investors nationally invested $37.5 million in 2,879 deals, down from $39.8 billion in 3,787 deals in the final three months of 2022.

Venture capital fundraising and exits also declined nationally last year.

“While the continued drop in activity does not lend itself to optimism, it would be a mistake to declare the market in crisis. Rather, the market has changed,” NVCA President and CEO Bobby Franklin wrote in the fourth quarter Venture Monitor report. “From interest rates to foreign conflict, the world looks very different than it did two years ago, and a new set of problems needs to be solved for.”

More from Crain’s Grand Rapids Business:

Amway supply chain exec forecasts ‘stabilizing’ year for direct-selling giant

Bills for drug review board, nursing staff mandates await state lawmakers

Investor-backed Grand Rapids firm helps campgrounds step into the digital age